by robwp |

Why You Need an Investor-Agent?

Investing in real estate can be a powerful way to build wealth, generate passive income, and secure long-term financial stability. However, navigating the complexities of real estate investment requires expertise, strategic planning, and market insight, that’s why you need an investor-agent that understands real estate from the business perspective.

Whether you’re buying or selling investment properties, having an experienced real estate agent with a strong background in investment properties is essential.

A knowledgeable agent understands the nuances of real estate as a business and can help you make informed decisions that maximize your returns.

Expertise in Investment Strategies

A real estate agent who is an expert in investment properties goes beyond simply finding homes—they understand real estate as an asset class. Unlike a typical residential agent, an investment-savvy realtor has the expertise to identify properties with high potential for appreciation and strong rental income. They analyze key factors such as:

-

Creative Financing

Providing insight into funding options, including using self-directed IRAs, and partnerships, and leveraging other real estate assets.

For buyers and sellers in Clifton and North New Jersey, Sanchez Realty Group, led by Roberto A. Sanchez, provides expert guidance in these areas. With over 30 years of experience, Roberto has gained the trust of his clients by consistently delivering top-notch service and helping them secure the best deals possible.

Negotiation Skills to Get the Best Deal

When it comes to investment properties, negotiation is everything. Unlike traditional homebuyers, investors focus on numbers, cash flow, and long-term financial gains.

A real estate agent with investment experience understands this and knows how to negotiate terms that benefit you, whether it’s a lower purchase price, seller concessions, or favorable financing terms.

Roberto A. Sanchez’s personable demeanor combined with his stern negotiation skills gives his clients an unfair advantage. His deep understanding of the Clifton and North New Jersey market allows him to structure offers that appeal to sellers while maximizing value for his clients.

A Proven Track Record with Investors

When selecting an agent, working with someone with a track record of successfully helping investors is essential. An agent who has assisted hundreds of investors knows what works and what doesn’t. They must have the experience to recognize good deals, assess risks, and guide you through the challenges that come with investment properties.

Sanchez Realty Group, led by Roberto A. Sanchez, has represented hundreds of investors, helping them maximize their portfolios through strategic investments. His knowledge in portfolio growth strategies, exit strategies, and identifying high-ROI properties makes him a trusted partner for serious investors.

Strong Industry Connections

Real estate investment isn’t just about buying and selling—it’s about building a network of trusted professionals. An agent with a strong reputation among his peers, including lenders, contractors, property managers, attorneys, CPAs, and other real estate professionals, can be a valuable asset to your investment journey.

Roberto A. Sanchez’s decades of experience have allowed him to build a strong network of trusted professionals. Whether you need reliable contractors for renovations, reputable lenders for investor-friendly financing, or access to off-market deals, Sanchez Realty Group can connect you with the right resources to make your investment journey smoother and more profitable.

Understanding the Unique Challenges of Investment Properties

Unlike residential real estate, investment properties require a different level of expertise, management, and strategy.

Investors must consider factors such as cash-on-cash returns, long-term income potential risk vs gains, using IRAs to invest in real estate, property appreciation, tax implications, and property management.

Many residential agents are not equipped to handle these complexities or not interested in this type of business, making it crucial to work with someone who is an expert in investment real estate.

With decades of hands-on experience, Roberto A. Sanchez understands the unique challenges investors face. From tenant management to lease structuring and legal compliance, his expertise ensures that investors are protected and profitable in their real estate investment deals in North Jersey and beyond.

Real estate investing is one of the most effective ways to build wealth, but success depends on working with the right professionals. An experienced real estate agent with a background in investment properties will provide invaluable insight, strategic negotiation, and access to the right resources.

They will help you identify profitable deals, avoid costly mistakes, and grow your portfolio over time.

If you’re serious about investing in real estate, don’t settle for just any agent. Work with the best—Sanchez Realty Group, led by Roberto A. Sanchez. With over 30 years of experience, an extensive network, and a proven track record of success, Roberto and his team will provide you with an unfair advantage in the market.

Are you ready to take your real estate investments to the next level? Contact Sanchez Realty Group today and let Roberto A. Sanchez help you build your wealth through real estate!

Call/Text Roberto A. Sanchez for a FREE consultation TODAY at 973-216-1945.

If you prefer to watch any of our videos on this topic, click below.

by robwp |

5 Home Selling Tips for Success

Selling your home can feel overwhelming, but with the right strategies and preparation, these 5 home selling tips for success can ensure you it stands out in the market. When you entrust your agent with the mission sell your home, the agent you choose MUST articulate how they will help you prepare, present, price, and promote your home to get your home sold for the most money in the shortest timeline possible, so, here we dive into the top 5 Home Selling Tips for Success when preparing to go on the market.

Let’s dive into some practical steps you can take to prepare your home for a successful sale.If you prefer take a look at this short video.

Why Presentation Matters

In today’s competitive real estate market, first impressions matter. Buyers are not only evaluating the physical aspects of your property but also the emotional connection they feel when they walk in. The best way to compete with other listings in your area is to present your home in its absolute best condition.

This doesn’t necessarily mean full-scale renovation but focusing on key areas can make a significant difference.

Well-presented homes often sell faster and for a higher price. Buyers form opinions within minutes of stepping onto a property. A clean, welcoming space helps them envision living there, which can drive up perceived value and generate strong offers. This is where attention to detail becomes critical. That’s where these simple 5 Home Selling Tips for Success among others could be of most help.

1. What’s the Value of Pre-Listing Inspections

One of the smartest moves you can make as a seller is to conduct a pre-listing inspection. This can include:

- Standard home inspections to identify structural or mechanical issues.

- Termite inspections to ensure there are no pest-related damages.

- Environmental inspections to uncover potential concerns like mold or radon.

By addressing these issues before listing, you can avoid surprises that might derail a sale later. It also shows buyers that you’re proactive and transparent, which builds trust and confidence.

Another benefit of pre-listing inspections is the negotiation power they provide. When potential buyers see that issues have already been resolved, they’re less likely to request costly repairs or concessions during the transaction. This can streamline the selling process, saving you time, money and keep things on track with no further inconveniences.

2. Preparation is Key and Affordable Repairs That Make a Big Impact

Preparing your home for sale doesn’t have to break the bank. Focus on repairs and upgrades that offer a high return on investment. Here are some tips:

- Fix dents, scratches, and minor damage. Even small flaws can make your home look neglected.

- Refinish walls and ceilings. A fresh coat of paint in neutral colors can do wonders for brightening up your space.

- Update fixtures and hardware. Replacing outdated light fixtures, cabinet handles, and faucets can modernize your home instantly.

- Enhance curb appeal. Sprucing up your exterior and landscaping creates a great first impression. Trim hedges, plant flowers, and ensure walkways are clear and inviting.

Curb appeal is often referred to as the “silent salesman” of your home. A welcoming exterior entices buyers to come inside from the moment they pull up to the property. Simple enhancements such as power washing your driveway, repainting your front door, or adding a new welcome mat can make all the difference.

Additionally, consider staging your home. Professionally staged homes often sell quicker and for higher prices because they highlight a property’s strengths while minimizing any weaknesses. If full staging isn’t in your budget, perhaps the main areas or focus on decluttering, depersonalizing, and rearranging furniture to maximize space.

3. The Power of Professional Assistance

You don’t have to handle everything alone. At the Sanchez Realty Group, we provide a pre-inspection checklist tailored to your home. This comprehensive guide helps you prioritize tasks and focus on what matters most. Additionally, we have a network of trusted contractors and handymen who can assist with:

- Minor repairs and touch-ups.

- Professional painting and finishing.

- Landscaping and exterior improvements.

- Cleaning and decluttering (at our expense).

Our team ensures that these upgrades are handled efficiently and professionally, giving you peace of mind. This proactive approach helps your home shine in a competitive market and appeals to discerning buyers.

4. Promoting and Marketing Your Home Effectively

Once your home is ready to list, it’s time to focus on marketing. Pre-staging consultation and preparation, high-quality (HDR) photographs, videos, matter ports, detailed, well-written descriptions, and strategic pricing and presentation are essential for attracting the right buyers. At Sanchez Realty Group, we use advanced marketing techniques, including:

- Professional photography and videography to showcase your home’s best features.

- Online and offline channels showcase your home at its best on major real estate platforms to maximize visibility and motivate traffic.

- Targeted social media marketing to reach a broader audience and the right buyers.

We also host MEGA open houses and private showings after attaining buyers’ pre-approval to ensure your home gets the exposure it deserves. Our goal is to present your property in a way that resonates with buyers and motivates them to make strong offers.

5. Know Your Home’s Value

Understanding your home’s current market value is essential for setting the right price and attracting serious buyers. If you’re curious about your home’s worth, we offer a free, no-obligation Price Analysis. This detailed report provides insights into:

- Comparable sales in your area.

- Current market trends.

- Strategic pricing to maximize your profit.

Accurate pricing is crucial, and its more than just looking at past sales and comparables, it’s looking at the specifics of your neighborhood, location, type of homes (amenities and benefits), attention to details (type of materials, quality of construction or renovations, etc) that the discerning buyers will appreciate and be willing to pay more for.

Overpricing can lead to your home sitting on the market for too long, while underpricing might leave money on the table. With our expertise, you can rest assured that your home will be priced competitively to attract buyers while maximizing your return.

Ready to Sell? Let’s Get Started!

Selling your home is a big decision, and we’re here to make it as seamless as possible. Whether you’re ready to list or just exploring your options, reach out to us for expert advice and personalized support, we believe in providing you with the information you need to make an informed decision when you’re ready.

Contact Sanchez Realty Group at United Real Estate, led by Roberto A. Sanchez, today:

- Call or text: 973-216-1945

- Email: rsanchez@robsrealtor.com

- Visit: www.robsrealtor.com

We’re committed to helping you achieve your real estate goals. Thank you for trusting us and for your referrals. We look forward to guiding you through every step of the home-selling process.

Check out our clients’ recommendations!

by robwp |

Why Multi-Generational Homes?

Buying a multi-generational home with Roberto A. Sanchez

In today’s housing market, families are rethinking how they live. Rising home prices, soaring interest rates, and increasing caregiving responsibilities have prompted many to embrace multi-generational home living.

At the Sanchez Realty Group, led by Roberto A. Sanchez at United Real Estate, we understand the unique needs of multi-generational households. Whether you’re looking for space to care for aging parents, share living expenses, or a combination of these needs whatsoever, we’re here to guide you every step of the way.

Looking for a home that fits your family’s lifestyle? Contact us today to find the perfect multi-generational property!

Important reasons many households consider when purchasing a multi-generational home:

1. Economic Pressures

With mortgage rates at their highest in years and home prices steadily climbing, many families find it more affordable to combine households. Sharing a home means splitting costs like utilities, taxes, and mortgage payments, making it a practical solution in an era of financial uncertainty. The trends is on the rise, the lack of available housing will be around for years to come and home prices will continue to increase.

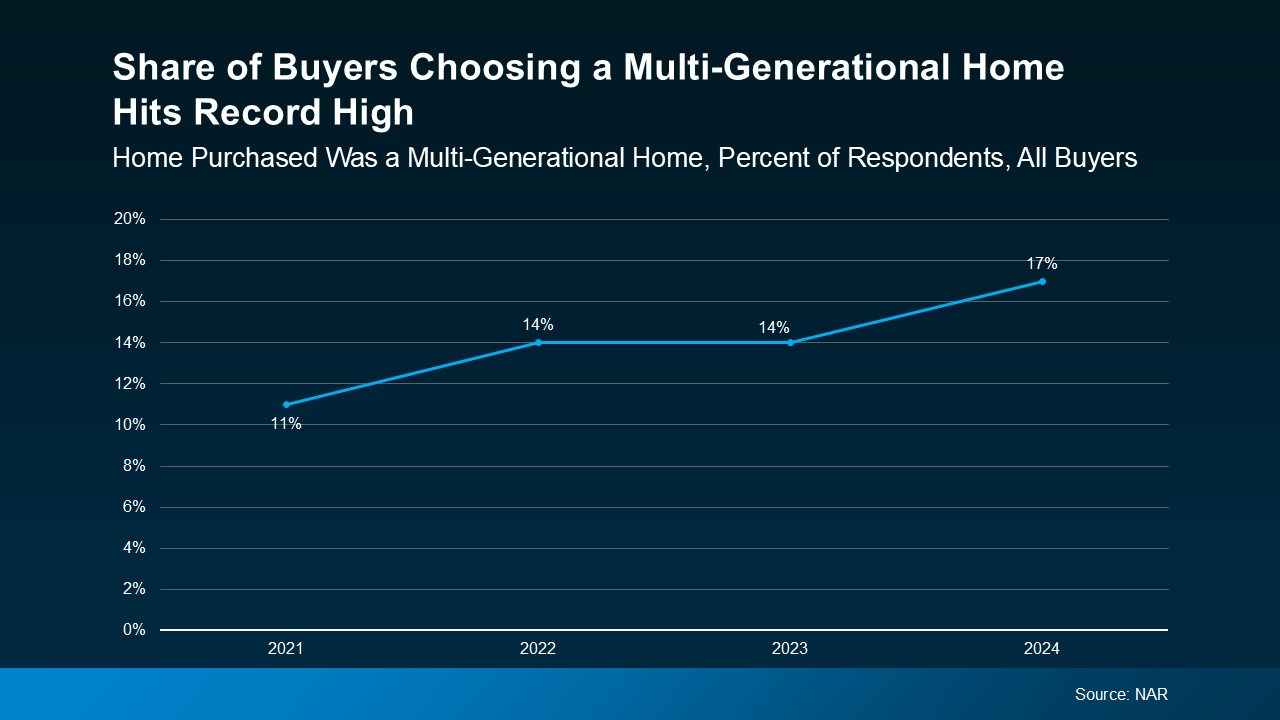

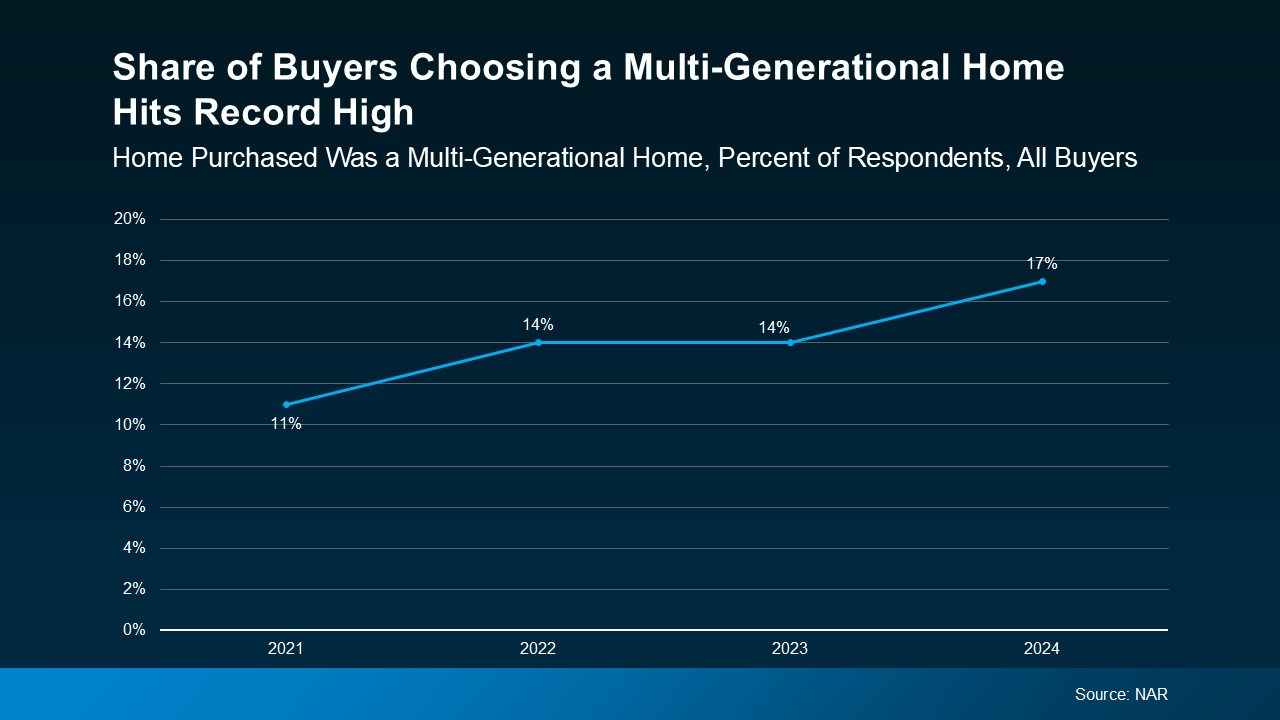

Today, 17% of homebuyers choose multi-generational homes — that’s when you buy a house with your parents, adult children, or distant relatives. What makes that noteworthy is that 17% is the highest level ever recorded by the National Association of Realtors (NAR). But what’s driving the recent rise in multi-generational living?

Buying a multi-generational home with Roberto A. Sanchez

2. Caregiving for Elderly Family Members

The cost of senior care has skyrocketed, and many families prefer to keep their aging parents close. Multi-generational homes allow elderly family members to live comfortably while staying connected with loved ones.

3. Supporting Younger Generations

For working parents, having grandparents nearby can tremendously help with childcare, school pickups, and a stronger bond between generations.

4. Cultural and Demographic Shifts

In many cultures, multi-generational living is a longstanding tradition. Changing demographics in the U.S. have contributed to this trend, as families from diverse backgrounds seek homes that accommodate their lifestyles.

📞 Ready to explore multi-generational living options in Clifton, NJ? Call us today at 973-216-1945 for expert guidance!

Benefits of Multi-Generational Living

1. Financial Savings

Pooling resources help families afford larger homes while reducing individual financial burdens.

2. Emotional and Social Support

Living together fosters deeper connections, reduces loneliness for seniors, and creates a built-in support system.

3. Convenience for Dual Responsibilities

Caring for both aging parents and young children—often referred to as the “sandwich generation”—is easier in a home designed for multi-generational use.

🏡 Browse homes with in-law suites and flexible layouts in Clifton, NJ, with Sanchez Realty Group today!

What to Look for in a Multi-Generational Home:

-

Separate Living Areas: Homes with in-law suites, extra kitchens, or private entrances and first-floor accommodations.

-

Accessibility Features: Single-level living spaces, wide doorways, or elevators for elderly family members, homes with living facilities in the first floor (bedrooms, bathrooms, and kitchens ease the burdens for aging family members).

-

Spacious Common Areas: Open kitchens and living rooms for family gatherings.

-

Proximity to Schools and Services: Convenient locations near schools, parks, healthcare facilities and easy access to shopping and major highways,

💬 Not sure where to start your multi-family or larger multi-generation home search? Schedule a consultation with Roberto A. Sanchez today to discuss your family’s unique needs.

At Sanchez Realty Group, we’ve helped hundreds of buyers and sellers over the last 30+ years navigate the complexities of finding the right multi-generational home. Whether you need space for aging parents, young kids, or both, we’ll help you identify properties with the right layout, location, and features and benefits.

📞 Contact us today to start your journey toward multi-generational living! Call 973-216-1945 OR or visit WWW.ROBSREALTOR.COM.

by robwp |

Buying a Home Grants in New Jersey

Buying a home grants in New Jersey: Are Grants Available to Help You Buy a Home in New Jersey?

The biggest hurdle to purchasing a home is saving for a down payment and closing costs, so buying a home with grants in New Jersey is possible. Fortunately, numerous grants, programs, and institutions can help, with purchasing a home Grants that are designed to assist first-time buyers and those with limited financial resources. In this blog, we’ll explore the types of assistance available, focusing on how buyers in towns like Clifton and across Northern New Jersey can benefit.

Types of Homebuyer Assistance Programs

New Jersey offers several types of homebuyer assistance programs:

1. Down Payment Assistance Programs

These programs provide grants or forgivable loans to help cover down payment and closing costs.

2. First-Time Homebuyer Programs

First-time buyers often qualify for additional benefits, including reduced interest rates and grants.

3. Local Assistance Programs

Some towns and counties have specific programs to encourage homeownership in their communities.

4. Additional Resources to Consider and Review:

Check this site from the Down Payment Resource in New Jersey

Statewide Programs in New Jersey

The state of New Jersey provides several key programs for homebuyers:

1. NJHMFA Down Payment Assistance Program

The New Jersey Housing and Mortgage Finance Agency (NJHMFA) offers a forgivable loan of up to $15,000 for qualified first-time homebuyers. Key benefits include:

- No repayment required if you stay in the home for five years.

- Available in towns like Clifton and other areas of Northern New Jersey.

2. Live Where You Work Program

- This program provides low-interest mortgage options to homebuyers purchasing a home in the town where they work. It’s particularly beneficial for buyers in urban areas such as Paterson, Newark, and Jersey City.

3. Federal Home Loan Bank (FHLB) Programs

- FHLB offers grants of up to $5,000 for first-time homebuyers through participating banks. These funds can be applied toward down payment and closing costs.

Local Assistance Programs in Northern New Jersey

1. Clifton First-Time Homebuyer Program

Clifton occasionally partners with local institutions to offer grants and counseling services for first-time buyers. Programs may include:

- Homeownership workshops.

- Down payment assistance.

2. Bergen County Homebuyer Assistance

Bergen County’s Division of Community Development offers funds to help low- and moderate-income buyers purchase homes. Towns such as Hackensack, Englewood, and Fort Lee may have additional localized initiatives.

3. Essex County First-Time Homebuyer Program

Essex County provides financial assistance to eligible buyers in towns like Montclair, Bloomfield, and East Orange.

4. Morris Habitat for Humanity

Morris Habitat for Humanity offers affordable housing opportunities and financial education workshops in towns like Parsippany and Morristown.

Institutions Offering Homebuyer Assistance

Numerous institutions in New Jersey support homebuyers, including:

1. Hudson County Economic Development Corporation (HCEDC)

HCEDC provides grants and financial counseling for homebuyers in towns like Hoboken and Jersey City.

2. United Way of Northern New Jersey

United Way offers resources to help families achieve homeownership, including financial literacy workshops and grants.

3. Affordable Housing Alliance (AHA)

The AHA provides affordable housing opportunities and education for buyers across New Jersey, including programs specifically tailored for Northern New Jersey residents.

4. Local Banks and Credit Unions

Many banks and credit unions in New Jersey partner with organizations like the Federal Home Loan Bank to provide grants and low-interest loans to eligible buyers.

How to Qualify for Assistance: Buying a home with a grant in New Jersey is possible.

Each program has specific eligibility requirements, which may include:

- Income Limits: Many programs are designed for low- to moderate-income households.

- First-Time Buyer Status: Some grants are reserved for first-time buyers or those who haven’t owned a home in the past three years.

- Location: Certain programs are tied to specific towns or counties.

- Credit Requirements: A good credit score is often necessary to qualify for assistance.

Steps to Take Advantage of Homebuyer Grants in Clifton and Beyond;

- Research Local Programs: Start by exploring programs in your town or county.

- Attend Workshops: Many organizations offer first-time homebuyer workshops that provide valuable information about grants and loans.

- Work with a Knowledgeable Realtor: A local expert like Roberto A. Sanchez at Sanchez Realty Group can help you navigate available programs and find homes that fit your budget.

- Get Pre-Approved for a Mortgage: This will help you determine your budget and identify which grants and loans you qualify for.

Why Clifton and Northern New Jersey Are Ideal for Homeownership

Clifton and surrounding towns offer a wide range of housing options, from single-family homes to condos, making them perfect for first-time buyers. The area also boasts:

- Proximity to major cities like New York.

- Excellent schools and community resources.

- Access to public transportation and major highways.

By taking advantage of local grants and assistance programs, you can make your dream of homeownership a reality in Clifton and Northern New Jersey.

Sanchez Realty Group and Roberto A. Sanchez: Your Partner in Homeownership

Navigating the world of homebuyer grants and assistance programs can be overwhelming, Buying a home with grants in New Jersey is possible and you don’t have to do it alone. Roberto A. Sanchez and the Sanchez Realty Group team are experts in the Clifton real estate market and Northern New Jersey and can connect you with the resources you need to succeed.

Ready to explore your options? Contact Sanchez Realty Group at United Real Estate today and take the first step toward owning your dream home in Clifton or Northern New Jersey.

by robwp |

Buying a Home in Foreclosure: A Guide for New Jersey Buyers

Are you considering buying a home in foreclosure in New Jersey? Foreclosures can be an attractive option for homebuyers and investors seeking below-market deals, but they come with unique challenges and risks. Understanding the foreclosure process and the market dynamics across New Jersey is key to making informed decisions.

What Is a Foreclosure?

A foreclosure occurs when a homeowner fails to make mortgage payments, leading the lender to repossess the property. These homes are often sold at a discount, making them appealing to buyers looking for affordability or investment potential. However, understanding the foreclosure process and the potential risks is crucial before diving in.

Why Consider Buying a Foreclosure?

- Lower Prices: Foreclosures are typically priced below market value, offering significant savings.

- Investment Opportunities: These properties are ideal for buyers interested in fixing and reselling (flipping) or renting them out.

- Potential Equity: With the right improvements, foreclosures can gain substantial value over time.

- Variety of Buyers: Foreclosures aren’t just for first-time homebuyers—they’re also attractive to seasoned investors, property developers, and those looking for multi-family rental opportunities.

Types of Foreclosure Sales

Understanding the different stages of foreclosure is essential for making informed decisions:

Pre-Foreclosure:

-

- The homeowner is in default but still owns the property.

- You can negotiate directly with the owner to purchase the home before it goes to auction.

Foreclosure Auction:

-

- Properties are sold at public auctions to the highest bidder.

- Buyers often need to pay in cash and have limited opportunities to inspect the property.

Real Estate Owned (REO) Properties:

-

- These homes did not sell at auction and are owned by the lender.

- Buying REO properties typically involves fewer risks than auctions and includes a traditional buying process.

Steps to Buying a Foreclosure Property

- Determine Your Budget

- Work with a lender to understand your financing options.

- Consider additional costs, such as repairs, inspections, and closing fees.

- Partner with an Experienced Real Estate Agent

- A knowledgeable agent can help you locate foreclosures, evaluate potential risks, and negotiate the best deal.

- Research the Property

- Perform due diligence to uncover any liens, unpaid taxes, or other encumbrances.

- Understand the property’s condition and market value to avoid overpaying.

- Inspect the Home

- Whenever possible, schedule a professional inspection to identify structural or mechanical issues.

- Be prepared for potential as-is sales, where repairs are your responsibility.

- Secure Financing

- Many buyers use cash, but specialized loans like FHA 203(k) or Fannie Mae’s HomePath can cover purchase and renovation costs.

- Work closely with your lender to determine the best option for your situation.

- Make an Offer

- Your agent will guide you in crafting a competitive offer based on market conditions and the property’s history.

- Be prepared for additional paperwork and lender requirements.

- Close the Deal

- The closing process for foreclosures can be more complex, so patience is key.

- Your real estate agent will assist with navigating any challenges and ensuring a smooth transaction.

Areas in New Jersey with Higher Foreclosure Rates

Certain regions in New Jersey tend to have a higher concentration of foreclosure properties. These include:

- Essex County: Cities like Newark and East Orange often have foreclosures due to urban density and economic factors.

- Passaic County: Areas such as Paterson and Passaic offer opportunities for both investors and homebuyers.

- Camden County: Foreclosures are common in cities like Camden, Trenton, and Pennsauken, with potential for revitalization projects.

- Atlantic County: Coastal towns, including Atlantic City, frequently have distressed properties due to fluctuations in the tourism-driven economy.

- Union County: Elizabeth and Linden are notable for foreclosure opportunities, particularly for multi-family and investment properties.

Potential Risks of Buying a Foreclosure

While foreclosures can offer great deals, they also come with challenges:

- Unknown Condition: Many foreclosures are sold as-is, meaning you inherit all repairs and issues.

- Competition: Other buyers and investors may drive up prices in popular areas.

- Extended Timelines: The foreclosure process can be lengthy, especially for REO properties.

- Legal Complications: Outstanding liens or disputes can complicate the sale.

Tips for Investors and Flippers

For investors and property flippers, foreclosures offer unique opportunities to maximize profits. Here are some additional strategies:

- Look for Undervalued Properties: Focus on homes in areas with strong market demand and growth potential.

- Build a Renovation Team: Work with reliable contractors and designers to handle renovations efficiently.

- Know Your Numbers: Calculate your after-repair value (ARV) and ensure your investment aligns with profit goals.

- Understand Local Zoning Laws: Ensure the property’s intended use aligns with zoning regulations, especially for multi-family or commercial ventures.

- Leverage Tax Benefits: Consult with a tax professional to understand deductions available for investment properties.

Why Buying Foreclosure Homes Appeal to Rental Property Buyers

For those interested in building rental portfolios, foreclosures provide:

- Affordable Entry Points: Lower purchase prices increase potential returns.

- Customization Potential: Renovate the property to meet tenant preferences and charge competitive rents.

- Scalability: Investors can acquire multiple properties within their budget, building a robust portfolio in areas with strong rental demand.

- Scarcity: Obviously with the higher demand and therefore prices of homes and real estate there are fewer foreclosures now and the best way to source better deals is with off-market.

Ready to Explore Foreclosure Opportunities?

Contact us at United Real Estate and Sanchez Realty Group, led by Roberto A. Sanchez, a trusted and experienced real estate professional to guide you through the complexities of purchasing foreclosure properties, if you’re buying a Home in Foreclosure in New Jersey. Whether you’re a first-time buyer, seasoned investor, builder, or property flipper, having the right team on your side ensures a smooth and informed buying experience.

by robwp |

Buying a Home for the First Time: A Complete Guide for Clifton Buyers

Are you a first-time homebuyer wondering where to start? These are the basic first-time buyer must-know steps, Buying your first home is an exciting milestone, but it can also feel overwhelming without the right guidance. The Sanchez Realty Group at United Real Estate, led by Roberto A. Sanchez, is here to simplify the process and help you achieve your dream homeownership in New Jersey.

Why Buy a Home in Clifton?

Clifton, NJ, is a vibrant community that perfectly balances suburban comfort and urban convenience. It’s diverse and inclusive neighborhoods, excellent schools, thriving shopping malls, and big box stores as well as smaller boutique-style businesses including a great choice of restaurants and entertainment options, and proximity to transportation all around.

Clifton has become a sought-after destination for first-time buyers. Whether you’re looking for a cozy starter home or a modern townhouse, the Clifton real estate market has something for everyone.

Additionally, Clifton boasts a range of recreational amenities, including beautiful parks, local eateries, and a thriving arts scene great for raising smaller children. Its proximity to New York City also makes it a fantastic option for commuters seeking a quieter lifestyle yet want the proximity to New York City has to offer, whether you are looking nearby Clifton or other areas, These are important first-time buyer must-know to follow up on.

Step 1: Determine Your Budget

One of the first steps to buying a home is understanding what you can afford. Here’s how to do it:

- Calculate Your Monthly Expenses: Consider your income, debts, and savings. Don’t forget to account for property taxes, insurance, and maintenance costs.

- Get Pre-Approved for a Mortgage: Work with a reputable lender to understand your borrowing capacity. This step shows sellers that you’re a serious buyer and have the capacity and ability to purchase their home and successfully get financing.

- Save for a Down Payment: While the standard is 20%, many first-time buyers can qualify with as little as 3.5% down, unless you’re a veteran and then purchase with no money down. Take advantage of programs like FHA loans, which are specifically designed for first-time buyers.

- Factor in Closing Costs: These can include loan origination fees, title insurance, and inspection fees, typically amounting to 2-5% of the home’s purchase price.

Step 2: Find the Right Real Estate Agent

Working with an experienced real estate agent like Roberto A. Sanchez can make all the difference. A local expert knows the ins and outs of the Clifton market and can:

- Guide you to neighborhoods that fit your lifestyle and budget.

- Negotiate on your behalf to secure the best deal.

- Provide insights on market trends and property values.

- Help you navigate the intricacies of the ever-changing real estate market.

- Connect you with trusted professionals, such as lenders, inspectors, attorneys, and contractors to streamline the process.

- Advise, and help to mitigate any issues that might arise.

With the Sanchez Realty Group, you’ll receive personalized attention and expert advice tailored to your unique needs.

Step 3: Start Your Home Search

With your budget and agent in place, it’s time to begin your search. Here’s what to keep in mind:

- List Your Priorities: Decide on your must-haves, such as the number of bedrooms, location, and proximity to schools.

- Tour Homes: Schedule showings and keep an open mind. Sometimes a property can surprise you.

- Use Online Tools: Websites like Zillow and Realtor.com can help you preview homes that match your criteria, also our website, www.robsrealtor.com .

- Explore Clifton Neighborhoods: From Montclair Heights to Lakeview, each area in Clifton has its unique charm. Take time to explore and find the perfect fit.

Step 4: Make an Offer

Once you’ve found the perfect home, your agent will help you craft a competitive offer. Key factors to consider:

- Comparable Sales: Look at recent sales of similar properties in the area, how fast or slow homes are selling, ask Roberto A. Sanchez for home prices in Clifton or other areas of interest.

- Market Conditions: Is it a buyer’s or seller’s market? Days on the market, average sales prices, etc.

- Contingencies: Include conditions such as inspections and financing to protect your interests.

- Earnest Money Deposit: This shows your commitment and is typically 1-5% of the home’s purchase price.

Step 5: Close the Deal

After your offer is accepted, the closing process begins. This includes:

- Choosing a Real Estate Attorney, and starting the REVIEW period.

- Home Inspection: Identify any issues that may need addressing.

- Complete your loan application.

- Appraisal: Ensure the property’s value aligns with your loan amount.

- Loan Finalization: Provide any additional documents required by your lender.

- Final Walkthrough: Confirm the home’s condition before closing.

- Closing Day: Sign all necessary paperwork and receive the keys to your new home!

Common Challenges First-Time Buyers Face

- Limited Inventory: Work closely with your agent to act quickly on desirable properties.

- Bidding Wars: Stay realistic and don’t exceed your budget.

- Unexpected Costs: Always have a contingency fund for repairs or unexpected expenses.

- Emotional Decisions: It’s easy to get attached but remember to prioritize practical considerations and always have your budget in mind.

Tips for First-Time Buyers; First-Time Buyer Must-Know That You Must Obey:

- Don’t Rush: Take your time to find the right home.

- Stay Within Budget: Avoid the temptation to stretch beyond your means.

- Ask Questions: EVERY and ANY question is important when it comes to your investment.

- Plan for the Future: Consider how the home will meet your needs in 5-10 years.

- Leverage Assistance Programs: Look into first-time buyer grants or tax incentives available in New Jersey.

Why Choose Sanchez Realty Group?

Roberto A. Sanchez and the team at Sanchez Realty Group specialize in helping first-time buyers navigate the Clifton real estate market. With over 30 years of experience and hundreds of homes successfully purchased and sold, (CHECK OUR REVIEWS), and a commitment to client satisfaction, we’re here to make your journey as smooth as possible.

Our personalized approach ensures you’re not just buying a house but finding a home that fits your dreams and lifestyle. From the first consultation to handing you the keys, we’re with you every step of the way.

Ready to Buy Your First Home?

Contact Sanchez Realty Group at United Real Estate today to schedule a consultation. Let us guide you through every step of the process and help you find your dream home in Clifton.

by robwp |

5 Ways to Buy Your Next Home CASH!

How Home Equity May Help You Buy Your Next Home Cash

For many homeowners, is very possible to buy your next home cash, this is why, the idea of buying your next home cash may feel like a distant dream. However, leveraging your home equity could make it a reality. Home equity is often one of the most powerful financial tools at your disposal, enabling you to transition into a new home with minimal or no financing in some cases.

In this blog post, we’ll explore how home equity works, the steps to access it, and why now might be the perfect time to use it. Along the way, we’ll highlight tips to maximize your equity and provide insights to help you make informed decisions.

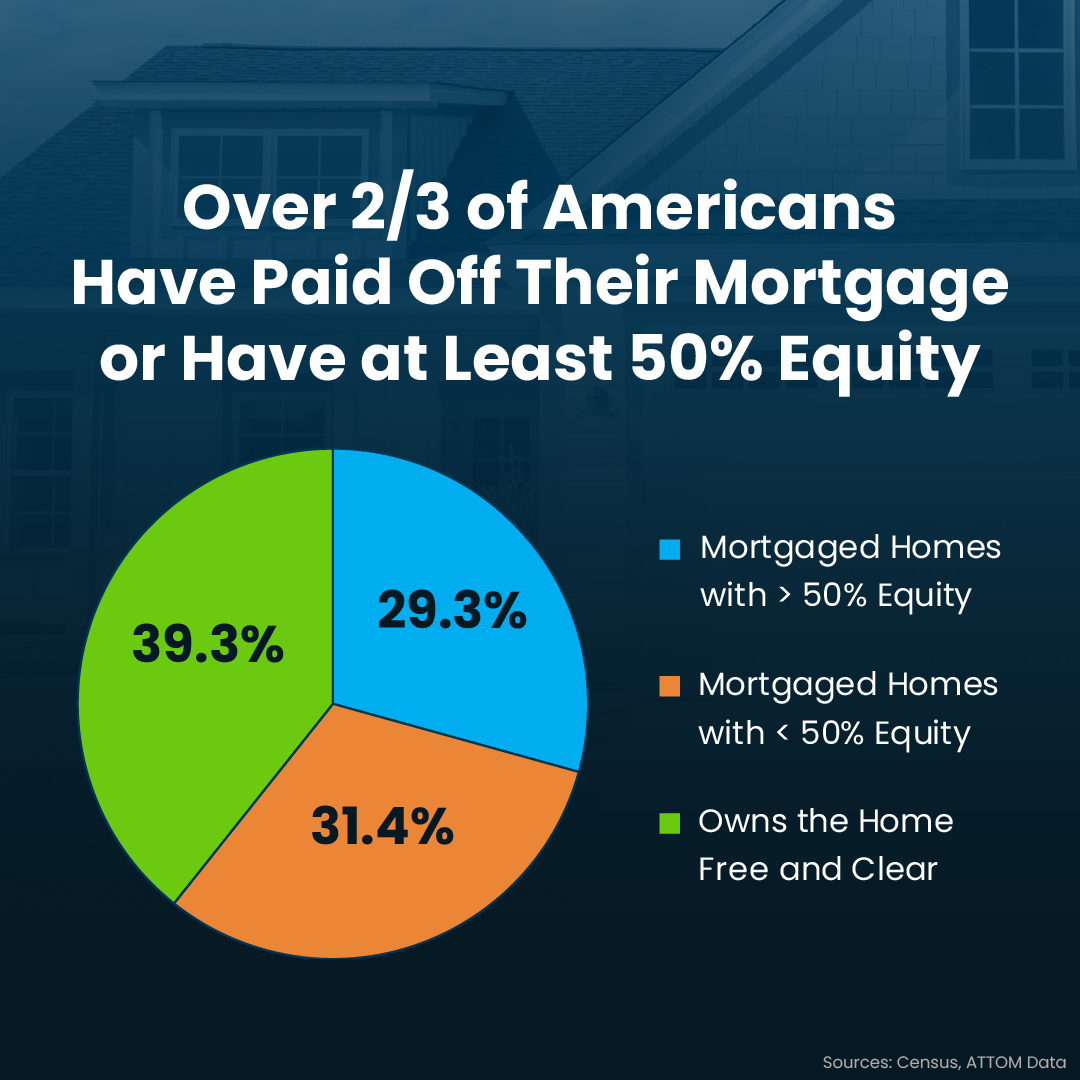

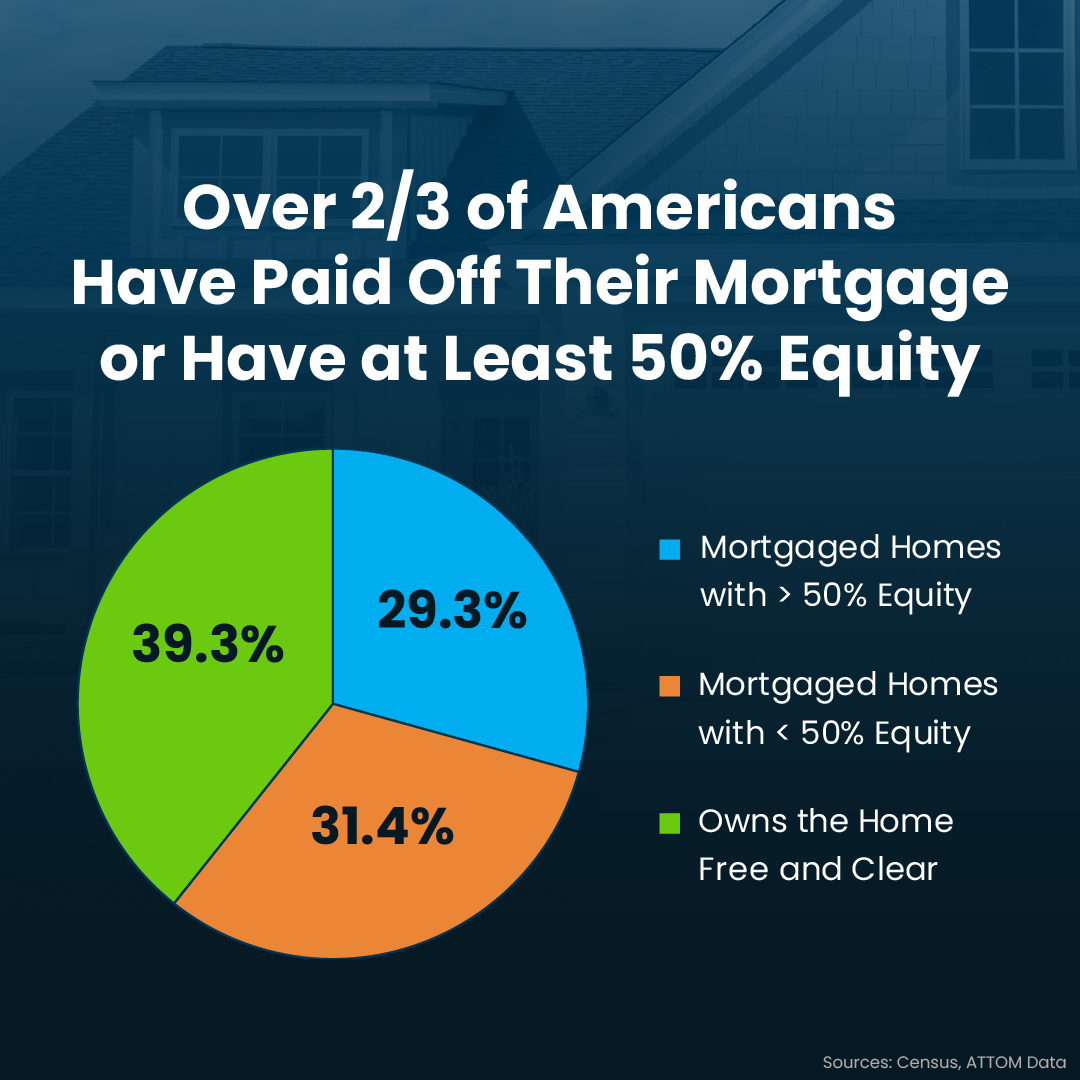

These are the stats for most homeowners in the US.

Over 2/3 of homeowners have either paid off their mortgage or have at least 50% equity in their home. And here’s what this really means for you. If you’re a homeowner wondering if it even makes sense to move right now, you should know you could have enough equity to buy your next house outright — no mortgage, no worrying about today’s rates.

What Is Home Equity?

Home equity is the difference between your home’s current market value and the outstanding balance on your mortgage. For example, if your home is worth $500,000 and your mortgage balance is $200,000, you have $300,000 in equity.

Over time, your equity grows as you pay down your mortgage and as your home’s value increases. This equity can be a powerful financial resource to help fund your next home purchase.

Key Benefits of Leveraging Home Equity

- Buy in Cash: Use equity to eliminate mortgage payments on your next home.

- Competitive Advantage: Cash offers often win in competitive markets.

- Simplified Transactions: Cash purchases usually involve fewer contingencies and faster closings.

- Leverage your Equity: Next to cash is putting down a substantial amount, 30, 40, or 50% is best if purchasing a higher-priced home or getting a lower mortgage.

Ways to Access Your Home Equity

To unlock your home equity, consider these popular methods:

1. Selling Your Current Home

Selling your home is the most straightforward way to access your equity. After paying off your existing mortgage, the remaining proceeds can be used to purchase your next property in cash.

Pro Tip: Before listing your home, consult a real estate expert to determine its market value and how much equity you can expect to cash out.

2. Home Equity Loan or Line of Credit (HELOC)

If you plan to buy a home before selling your current property, a HELOC or home equity loan can provide the necessary funds.

- Home Equity Loan: Borrow a lump sum against your equity.

- HELOC: A flexible line of credit you can draw from as needed.

3. Cash-Out Refinance

A cash-out refinance involves replacing your existing mortgage with a larger one and withdrawing the difference as cash. This option is ideal for homeowners who want to maintain their current home while buying another, IF YOU HAVE A MULTI-FAMILY home, it might be a sound decision to convert it into a positive cash-flow rental.

Step-by-Step Guide to Using Home Equity to Buy Your Next Home

Step 1: Assess Your Home’s Value

Start by getting a professional home valuation or a Comparative Market Analysis (CMA) from a local real estate agent.

Step 2: Calculate Your Equity

Subtract your outstanding mortgage balance from your home’s market value. This is your available equity.

Step 3: Explore Financing Options

Decide how you want to access your equity. If selling your home, work with a real estate agent to determine the best timing and strategy.

Step 4: Plan Your Next Purchase

Research neighborhoods, price points, and property types for your next home. Having a clear plan will streamline the buying process.

Step 5: Execute Your Strategy

Work with professionals—real estate agents, lenders, and financial advisors—to finalize your sale and purchase.

Why Now Is a Great Time to Leverage Home Equity

Current market conditions may favor homeowners looking to cash in on their equity. Here’s why:

High Home Values

Home prices have risen significantly in recent years, boosting equity levels for many homeowners.

Limited Housing Inventory

Cash offers give you a competitive edge in a market with limited supply and high demand.

Low Inventory, High Demand

A strong seller’s market means you can maximize your equity when selling your current home.

Tips to Maximize Your Home Equity

1. Make Strategic Renovations

Focus on upgrades that provide high returns, such as kitchen remodels or energy-efficient improvements.

2. Reduce Outstanding Debt

Pay down your mortgage as much as possible to increase your equity.

3. Time the Market

Sell when home values are at their peak for maximum equity gains.

Potential Challenges and How to Overcome Them

Challenge 1: Timing the Sale and Purchase

It can be tricky to coordinate selling your current home and buying your next one.

Solution: Consider a temporary rental or bridge loan to ease the transition. We have extensive experience negotiating and your best options with buyers in a market favorable to sellers is to possible to arrange extra time to close or work out a sale/rent agreement if needed.

Challenge 2: Fluctuating Home Prices

Market volatility could affect the value of your home.

Solution: Stay informed about market trends and work with a knowledgeable real estate agent.

Let’s Make Your Cash Purchase a Reality

Ready to turn your home equity into a cash offer for your next dream home? Contact us TODAY and The Sanchez Realty Group at United RE for a personalized consultation. We’ll help you assess your equity, navigate the market, and find the perfect property.

by robwp |

Doing Small Income Property Analysis and educating income property buyers and small investors on how to do small-income property analysis on the potential income of small investment properties should be an important trait of a real estate professional.

We also assist home buyers and investors interested in purchasing multi-family properties to create passive income through rentals and create equity over time.

This Small Income Property Analysis information video could assist the beginner investor with the basics analysis to make a better-informed purchase.

There are several approaches and analysis methods investors utilize to make sure they’re making a sound decision.

These simple methods quickly tell you if the property meets your investment objectives whether they’re smaller investments; 2-4 units or larger properties.

I’m Roberto A. Sanchez with United RE and the Sanchez Realty Group, I’ll explain some of the most common methods used to analyze a property.

For the sake of this illustration we will use a 2-unit property with a purchase price of $300,000 and a rental income of $3,000 a Month.

These 4 Analysis Methods are Most Commonly Used:

1st Net Operating Income:

Gross Rental Income – Operating Expenses

Ex: $3,000 x 12 months (Income) – $11,000 (Expenses) or $36,000 – 11,000 or $27,000 NOI (Net Operating Income – Before Mortgage)

2nd Cap Rate:

Net Operating Income / Total Purchase Price

Ex: $27,000 / $300,000 = 9% Cap Rate

3rd 1st One Percent Rule:

Monthly Gross Rent >= 1 % of Total Purchase Price

Ex: $3,000 >= 1% of $300,000 = $3,000

4th Net Income After Mortgage (NIAM)

Net Operating Income – Mortgage or Finance Costs

$27,000 – $12,900 (Principal + Interest) = $14,100 (NOI)

4th Cash on Cash Return (CoCr or COC):

Net Income After Mortgage / Down Payment

Ex: $14,100 / $75000 = 18% COC

Other Methods are:

The Gross Rent Multiplier:

Total Purchase Price / Yearly Gross Rent

Ex: $300,000 / $36,000 = 8.3

The 50% Rule:

It estimates the NOI at 50% of Gross rents

Ex: $36,000 yearly GR x 50% = $18,000.

Counties/Towns with Investment Properties

in Northern New Jersey

Bergen County Multifamily Properties

Morris County Multifamily Properties

Passaic County Multifamily Properties

Union county Multifamily Properties

Essex County Multifamily Properties

Sussex County Multifamily Properties

by robwp |

Clifton Housing Market Trends: What Sellers Need to Know

Why Understanding The Clifton Housing Market Trends Matters

Are you wondering, “What’s happening in the Clifton housing market right now?” Knowing current trends is essential for anyone planning to sell a home in Clifton. These insights help you determine the best pricing strategy, timing, and marketing approach. Roberto A. Sanchez and the Sanchez Realty Group at United Real Estate are experts in Clifton real estate, have in-depth knowledge of the many neighborhoods and overall market as residents over 30 years, and offer invaluable guidance to home sellers.

What Defines a Seller’s Market in Clifton?

A seller’s market occurs when there are more buyers than available homes. Clifton, NJ, is currently experiencing this phenomenon, driven by:

- Limited Inventory: The number of homes for sale in Clifton is relatively low, creating competition among buyers.

- High Demand: Buyers are attracted to Clifton for its convenient location, excellent schools, and vibrant community.

- Rising Home Prices: With high demand and low supply, home values in Clifton have steadily increased, giving sellers the upper hand.

- Buyers’ Desirability: Buyers are offered diversity, convenience and affordability

Understanding these dynamics can help sellers set realistic expectations and prepare for a smooth transaction process.

Key Trends in the Clifton Real Estate Market

Trend #1: Rising Home Prices

Clifton has seen consistent home price appreciation over the past few years. For sellers, this trend means greater returns on investment. According to recent market reports, the average home price in Clifton has increased by X% compared to last year, reflecting strong buyer demand.

Rising prices not only benefit sellers but also indicate a healthy, stable market. However, pricing too high can still deter potential buyers. Consulting with an experienced real estate agent, like Roberto A. Sanchez, can help you strike the perfect balance.

Trend #2: Low Days on Market

Homes in Clifton are selling faster than ever. The average days on the market (DOM) have decreased, signaling a robust market where well-priced homes attract offers quickly. Sellers who price competitively can expect multiple offers within days of listing.

This fast pace means sellers need to be prepared. Before listing, ensure your home is market-ready with necessary repairs, decluttering, and staging. Quick sales require strategic planning, which is where the expertise of Sanchez Realty Group becomes invaluable, negotiation skills is a must in today’s market to help you achieve your highest price gains while enjoying a stress-free possible transaction.

Trend #3: Buyer Preferences Are Shifting

Today’s buyers are prioritizing:

- Home Offices: With more people working remotely, functional office spaces are a top priority.

- Outdoor Living: Features like decks, patios, and spacious yards are highly desirable.

- Modern Kitchens and Bathrooms: Updated, move-in-ready homes often fetch higher prices.

- Open Layout and Modern Decor: Preparing your home and introducing subtle and economical updates could bear the best return on investment (ROI).

If your Clifton home aligns with these trends, you’re in a strong position to attract motivated buyers. Even if your home doesn’t currently meet these criteria, small upgrades can significantly enhance its appeal.

Trend #4: Technology-Driven Home Searches

The rise of online platforms and virtual tours has transformed how buyers search for homes. Most buyers begin their search online, presenting high-quality photos, detailed and well-crafted listing descriptions, virtual walkthroughs, and matter-port, aerial videos, and neighborhood-specific informational videos are essential. Sellers in Clifton should leverage these tools to showcase their homes effectively. Partnering with a tech-savvy real estate team like Sanchez Realty Group ensures your home receives maximum online and offline exposure.

Trend #5: Local Market Stability

Clifton’s real estate market has remained stable despite national economic fluctuations. The town’s strong sense of community, excellent amenities, and proximity to major cities make it a desirable location. This stability reassures both buyers and sellers, fostering confidence in the market.

How to Leverage Market Trends to Your Advantage

Work with an Experienced Realtor

Partnering with an experienced Clifton real estate agent like Roberto A. Sanchez ensures you have access to the latest market data and professional insights. Sanchez Realty Group excels at positioning your home to maximize its value in today’s market.

An experienced agent can also guide you through negotiations, helping you secure the best possible price and terms. Their expertise is especially critical in a fast-moving market like Clifton’s, where timing and strategy can make all the difference.

Price Strategically

Setting the right price is crucial. Overpricing can deter buyers while underpricing leaves money on the table. With expert guidance from Sanchez Realty Group, you’ll receive a detailed comparative market analysis (CMA) to determine the optimal price for your home.

Strategic pricing involves understanding both local and national trends. For example, while Clifton may be experiencing a seller’s market, broader economic factors like interest rates and inflation can still impact buyer behavior. A knowledgeable real estate agent will help you navigate these complexities.

Timing Your Sale

While the Clifton market is currently favorable for sellers, timing your sale strategically can further enhance your results. Consider seasonal trends, buyer activity, and your personal goals when planning your sale. For example:

- Spring and Summer: These are traditionally the busiest times for real estate, especially in the Northeast due to the warmer, longer days, with more buyers actively searching for homes.

- Fall and Winter: Although less busy, these seasons can still be advantageous, especially for well-prepared sellers. Serious buyers who remain active during these months are often highly motivated and ready to transact which might be best since you have a lot less competition with less homes in the market.

Enhance Your Home’s Appeal

Even in a seller’s market, presentation matters. Invest in minor upgrades, such as fresh paint, updated fixtures, and landscaping, to make your home more appealing. Staging your home can also help buyers envision themselves living there, increasing the likelihood of a quick sale.

Why Choose Sanchez Realty Group?

Selling a home in Clifton requires a tailored approach, and that’s exactly what you’ll get with Roberto A. Sanchez. With deep local knowledge and a proven track record, intrinsically knowledgeable about the Clifton Housing Market Trends, Sanchez Realty Group ensures your home stands out in the competitive Clifton market. From expert staging advice to aggressive marketing strategies, they handle every detail to secure the best outcome, always looking after your best interest.

Sanchez Realty Group’s commitment to personalized service sets them apart. By taking the time to understand your goals and concerns, they create a customized selling strategy that meets your needs. Their extensive network and marketing expertise further enhance your home’s visibility, attracting qualified buyers and maximizing your return.

Conclusion

Understanding housing market trends is key to a successful home sale in Clifton, NJ. By staying informed and working with an expert real estate agent like Roberto A. Sanchez, you’ll be well-equipped to navigate the market and achieve your goals.

Selling a home is a significant milestone, and you don’t have to go through it alone. Contact Sanchez Realty Group today to schedule a consultation and take the first step toward a successful sale.

by robwp |

Capital Gains Taxes?… How to Sell a Home Without Paying Capital Gains Tax: What Home Sellers Need to Know

If you’re planning to sell your home, you may be wondering how to avoid capital gains taxes. Understanding the rules and available exemptions can save you thousands of dollars and help you keep more profit in your pocket. While taxes can be complex, there are clear ways you can reduce or eliminate your capital gains liability when selling a home. In this blog, we’ll break it all down in plain language, focusing on what homeowners in Clifton, NJ, need to know.

Before we begin, a quick disclaimer: This blog is for informational purposes only and does not constitute tax, legal, or financial advice. Always consult a tax professional, CPA, or attorney for guidance specific to your situation.

What Are Capital Gains Taxes?

When you sell a home, the IRS considers the profit you make from the sale as a “capital gain.” Capital gains taxes are simply the difference between the amount you paid for the home (your cost basis) and the amount you sold it for (your sale price).

For example:

- If you bought your home for $200,000 and sold it for $400,000, your capital gain is $200,000.

Capital gains are taxable, but there are exceptions and exclusions specifically designed to help homeowners reduce or eliminate these taxes.

The Home Sale Exclusion Rule

The good news for homeowners is that the IRS offers a generous Home Sale Exclusion, also known as the Section 121 Exclusion. This rule allows you to exclude up to:

- $250,000 of capital gains if you are a single filer.

- $500,000 of capital gains if you are married and filing jointly.

For many homeowners, this means you may owe no taxes at all on the sale of your primary residence. However, you must meet certain criteria to qualify for this exclusion.

How to Qualify for the Home Sale Exclusion

To claim the exclusion, you must meet two key requirements:

- Ownership Test: You must have owned the home for at least two years during the five years leading up to the sale.

- Use Test: You must have used the home as your primary residence for at least two of the last five years.

If you meet both the ownership and use tests, you can take full advantage of the exclusion limits.

Example: Let’s say you bought your Clifton home for $300,000 and sold it for $600,000. If you are a married couple filing jointly, you can exclude up to $500,000 of the gain. That means you won’t owe any capital gains taxes because the $300,000 gain is fully excluded.

Partial Exclusion for Special Circumstances

If you don’t meet the full ownership and use tests, you may still qualify for a partial exclusion of capital gains. Special circumstances include:

- A job relocation (moving more than 50 miles away).

- Health-related reasons.

- Unforeseen events, such as divorce or natural disasters.

Even if you’ve only lived in your home for a short time, it’s worth exploring whether you can claim a partial exclusion.

Example: You lived in your home for just 18 months before accepting a job relocation. While you don’t meet the two-year requirement, you may still qualify for a prorated exclusion based on the time you lived in the home.

How Improvements Impact Your Capital Gains

Did you know that home improvements can reduce your taxable gain? The IRS allows you to add the cost of qualifying capital improvements to your home’s cost basis. This effectively reduces the amount of your capital gain.

What Counts as a Capital Improvement?

Capital improvements include any upgrades that:

- Increase the value of your home.

- Extend the useful life of your home.

- Adapt your home for new uses.

Some examples include:

- Adding a new roof, deck, or swimming pool.

- Installing a new HVAC system or windows.

- Renovating the kitchen or bathrooms.

- Adding a home office or converting an attic or basement into living space.

Example: You purchased your home for $250,000 and spent $50,000 upgrading the kitchen and adding a deck. When you sell the home for $400,000, your cost basis is now $300,000 ($250,000 purchase price + $50,000 improvements). This reduces your capital gain to $100,000 instead of $150,000.

Keep Records of Improvements

To take advantage of this rule, keep detailed records of all improvements, including receipts, invoices, and permits. This documentation will be invaluable when calculating your cost basis and minimizing your taxable gain.

Pro Tip: If you’re planning to sell your home in the next few years, consider making strategic upgrades that not only boost your home’s value but also reduce your taxable gain.

Avoiding Capital Gains Taxes When Selling an Inherited Home

If you’ve inherited a home, the capital gains calculation is different. Instead of using the original purchase price as the cost basis, the IRS allows you to use the home’s fair market value (FMV) at the time of inheritance.

This is called a stepped-up basis, and it significantly reduces your capital gain.

Example: If your parents bought a Clifton home for $150,000 years ago and you inherit it when it’s worth $500,000, your cost basis is now $500,000. If you sell the home for $510,000, your capital gain is only $10,000.

This rule is particularly helpful for heirs who plan to sell an inherited property quickly.

Special Note for Multiple Heirs

If multiple people inherit a home (e.g., siblings), the stepped-up basis applies proportionally to each heir’s share. For example, if you inherit half of a $500,000 home, your stepped-up basis is $250,000.

Strategies for Reducing Capital Gains Taxes

If you anticipate a significant capital gain on your home sale, here are additional strategies to minimize your tax liability:

- Timing Your Sale: If you’re close to meeting the two-year ownership and use tests, consider delaying the sale to qualify for the full exclusion.

- Renting Before Selling: If you’ve used the home as a rental, you may still qualify for the exclusion if you meet the ownership and use tests.

- Offset Gains with Losses: You can offset capital gains with losses from other investments (known as tax-loss harvesting).

Consult a Tax Professional

While there are clear strategies for avoiding or minimizing capital gains taxes, every homeowner’s situation is unique. Tax laws are complex and constantly evolving, so it’s important to work with a qualified tax professional or CPA. They can help you:

- Calculate your cost basis accurately.

- Determine your eligibility for exclusions.

- Plan your sale to minimize taxes.

At Sanchez Realty Group, we specialize in helping homeowners navigate the selling process in Clifton, NJ, and surrounding areas. While we can’t provide tax advice, we can connect you with trusted local professionals who can.

Final Thoughts

Selling a home without paying capital gains taxes is possible if you take advantage of the IRS rules, exclusions, and deductions available to you. By understanding the Home Sale Exclusion, tracking your capital improvements, and working with qualified professionals, you can keep more of your hard-earned profits.

If you’re thinking about selling your home in Clifton or Fairlawn, NJ, the team at Sanchez Realty Group is here to help. We’ll guide you through every step of the process and ensure you have the resources you need to make informed decisions.

Ready to Sell Your Home?

Contact Roberto A. Sanchez and the team at Sanchez Realty Group today. Let us help you make your next move with confidence and clarity!

by robwp |

5 Home Selling Tips For A Successful Sale

Selling your home can feel overwhelming, but with the right strategies and preparation, you can ensure it stands out in the market. At Sanchez Realty Group, and Roberto A. Sanchez, our mission is to help homeowners like you get the best results, I strongly believe if you go through these 5 Home Selling Tips you can achieve a better home presentation to appealing buyers.

Let’s dive into these 5 Home Selling Tips and practical steps you can take to prepare your home for a successful sale.

Why Presentation Matters

In today’s competitive real estate market, first impressions matter. Buyers are not only evaluating the physical aspects of your property but also the emotional connection they feel when they walk in. The best way to compete with other listings in your area is to present your home in its absolute best condition and these 5 Home Selling Tips can help you accomplish these with minimum inconveniences.

This doesn’t necessarily mean full-scale renovation but focusing on key areas can make a significant difference.

Homes that are well-presented often sell faster and for a higher price. Buyers form opinions within minutes of stepping onto a property. A clean, welcoming space helps them envision themselves living there, which can drive up perceived value and generate strong offers. This is where attention to detail becomes critical.

1. What’s the Value of Pre-Listing Inspections

Conducting a pre-listing inspection is one of the smartest moves you can make as a seller. This can include:

- Standard home inspections to identify structural or mechanical issues.

- Termite inspections to ensure there are no pest-related damages.

- Environmental inspections to uncover potential concerns like mold or radon.

Addressing these issues before listing can avoid surprises that might derail a sale later. It also shows buyers that you’re proactive and transparent, which builds trust and confidence.

Another benefit of pre-listing inspections is the negotiation power they provide. When potential buyers see that issues have already been resolved, they’re less likely to request costly repairs or concessions during the transaction. This can streamline the selling process, saving you time, and money, and keeping things on track with no further inconveniences

2. Preparation is Key and Affordable Repairs That Make a Big Impact

Preparing your home for sale doesn’t have to break the bank. Focus on repairs and upgrades that offer a high return on investment. Here are some tips:

- Fix dents, scratches, and minor damage. Even small flaws can make your home look neglected.

- Refinish walls and ceilings. A fresh coat of paint in neutral colors can do wonders for brightening up your space.

- Update fixtures and hardware. Replacing outdated light fixtures, cabinet handles, and faucets can modernize your home instantly.

- Enhance curb appeal. Sprucing up your exterior and landscaping creates a great first impression. Trim hedges, plant flowers, and ensure walkways are clear and inviting.

Curb appeal is often referred to as the “silent salesman” of your home. A welcoming exterior entices buyers to come inside from the moment they pull up to the property. Simple enhancements such as power washing your driveway, repainting your front door, or adding a new welcome mat can make all the difference.

Additionally, consider staging your home. Professionally staged homes often sell quicker and for higher prices because they highlight a property’s strengths while minimizing any weaknesses. If full staging isn’t in your budget, perhaps the main areas or focus on decluttering, depersonalizing, and rearranging furniture to maximize space.

3. The Power of Professional Assistance

You don’t have to handle everything alone. At the Sanchez Realty Group, we provide a pre-inspection checklist tailored to your home. This comprehensive guide helps you prioritize tasks and focus on what matters most. Additionally, we have a network of trusted contractors and handymen who can assist with:

- Minor repairs and touch-ups.

- Professional painting and finishing.

- Landscaping and exterior improvements.

- Cleaning and decluttering (at our expense).

Our team ensures that these upgrades are handled efficiently and professionally, giving you peace of mind. This proactive approach helps your home shine in a competitive market and appeals to discerning buyers.

4. Promoting and Marketing Your Home Effectively

Once your home is ready to list, it’s time to focus on marketing. High-quality HDR photographs, aerial and video of your home, well-written, detailed descriptions, launch preparation with offline and online exposure, and strategic pricing are essential for attracting the right buyers. At Sanchez Realty Group, we use advanced marketing techniques, including:

- Professional photography and videography to showcase your home’s best benefits and features.

- Online listings on major real estate platforms to maximize visibility.

- Social media marketing to reach a broader audience.

We also host MEGA open houses and private showings after attaining buyers’ pre-approval to ensure your home gets the exposure it deserves. Our goal is to present your property in a way that resonates with SERIOUS buyers and motivates them to make strong offers.

5. Know Your Home’s Value

Understanding your home’s market value is essential for setting the right price and attracting serious buyers. If you’re curious about your home’s worth, we offer a free, no-obligation Price Analysis. This detailed report provides insights into:

- Comparable sales in your area.

- Current market trends.

- Strategic pricing to maximize your profit.

Accurate pricing is crucial, and its more than just looking at past sales and comparables, it’s looking at the specifics of your neighborhood, location, type of homes (amenities and benefits), attention to details (type of materials, quality of construction or renovations, etc) that the discerning buyers will appreciate and be willing to pay more for.

Overpricing can cause your home to sit on the market for too long and become stale deterring potential buyers from looking at it, while underpricing might leave money on the table. With our expertise, you can rest assured that your home will be priced competitively to attract buyers while maximizing your return and negotiating the best terms and conditions.

Ready to Sell? Let’s Get Started!

Selling your home is a big decision, and we’re here to make it as seamless as possible. Whether you’re ready to list or just exploring your options, reach out to us for expert advice and personalized support.

Contact Sanchez Realty Group at United Real Estate, led by Roberto A. Sanchez, today:

-

Call or text: 973-216-1945

-

Email: rsanchez@robsrealtor.com

-

Visit: www.robsrealtor.com

We’re committed to helping you achieve your real estate goals. Thank you for trusting us and for your referrals. We look forward to guiding you through every step of the home-selling process.

Ready to Sell Your Home?

Don’t leave your biggest investment to chance.

Contact Sanchez Realty Group today for a personalized consultation and let’s work together to achieve your real estate goals and exceed your expectations!

Call/text or email me TODAY at 973-216-1945, rsanchez@robsrealtor.com

Contact Us For A Consultation

Are You Curious About Your New Value?

by robwp |

Your Complete Guide to Selling a Home in Clifton, NJ

Your Complete Guide to Selling a Home in Clifton, NJ

Are you considering selling your home in Clifton, NJ, but aren’t sure where to start?

This comprehensive and complete guide to selling a home in Clifton, Nj is designed to help you navigate the selling process with ease and confidence when you decide to sell your home. Whether you’re considering to sell in the near future, preparing your property for the market or looking for expert advice . The Sanchez Realty Group at United Real Estate, and Roberto A. Sanchez, is the best professional to guide you every step of the your real estate journey.

Selling a home is a significant decision, both emotionally and financially, and partnering with the best real estate agent in Clifton can make all the difference. As Clifton’s trusted Realtor, Roberto A. Sanchez has a proven track record of helping homeowners achieve their goals, helping homeowners prepare, market, negotiate and sell their homes for over 3 decades.

Why Sell Your Home in Clifton, NJ?

Clifton offers a unique combination of urban convenience and suburban charm, making it a sought-after location for homebuyers. Its nearby major highways, public transportation, shopping, entertainment and proximity to New York City attracts commuters, while its excellent schools, parks, and diverse neighborhoods appeal to families and professionals alike.

High Demand in the Clifton Real Estate Market

The Clifton real estate market is currently experiencing high demand, with buyers eager to secure properties in this desirable area with its many neighborhoods and its wide range of homes and prices. Whether you own a single-family home, multi-family , a townhouse, or a condominium, you can benefit from the competitive environment and achieve a favorable sale.

Timing Is Everything

Market trends show that selling a home in Clifton during certain times of the year can yield better results. Spring and summer often see increased buyer activity specially in the North East due to the so called “Spring Market”, but even in other seasons, a well-prepared home can stand out. Roberto A. Sanchez will help you assess the best timing based on your goals and the current market conditions, in fact, during the holidays and winter months when there’s less traffic of buyers, a well presented home will attract more serious buyers willing to go above and beyond to get the home of their choice.

Step-by-Step Guide to Selling Your Home

Step 1: Partner with a Local Expert

The first and most crucial step in selling your home is finding the right Realtor. A knowledgeable professional like Roberto A. Sanchez understands the nuances of the Clifton real estate market and will work tirelessly to position your property for success.

Local expertise matters. Roberto’s in-depth understanding of Clifton’s neighborhoods, buyer preferences, and pricing trends ensures your home gets the attention it deserves.

Step 2: Understand Market Trends

Before listing your home, it’s important to understand what buyers in Clifton are looking for. Here are some trends to keep in mind:

- Important feature and benefits: Homes with modern kitchens, updated bathrooms, and outdoor spaces tend to attract more interest.

- Neighborhood Appeal: Proximity to schools, parks, and public transportation adds value to your property.

- Competitive Pricing: A well-priced home generates more interest and can lead to multiple offers.

- Preparation and presentation is key to place your home above similar competing homes and draw more and better offers.

Pro Tip: Request a free market analysis from Sanchez Realty Group to understand how your home compares to others in the area.

Step 3: Prepare Your Home for Sale

By utilizing this A well-presented home can make a lasting impression on potential buyers. Follow these tips to get your home market-ready:

Declutter and Deep Clean

Remove personal items and excess clutter to create a clean, inviting space. A tidy home allows buyers to envision themselves living there.

Make Repairs

Address minor repairs, such as leaky faucets, chipped paint, or squeaky doors. These small fixes can prevent potential buyers from focusing on flaws.

Stage Your Home

Professional staging highlights your home’s best features and can increase its perceived value. If staging isn’t an option, arrange furniture to maximize space and light.

Boost Curb Appeal

First impressions matter. Mow the lawn, trim bushes, and add fresh flowers or a new welcome mat to make your home inviting from the outside.

Step 4: Price Your Home Strategically

Determining the right price is one of the most critical aspects of selling your home. Overpricing can lead to a stagnant listing, while underpricing may result in lost equity.

Factors Influencing Price:

- Recent sales of similar homes in Clifton

- Current market conditions

- Unique features and upgrades in your home

Using advanced tools and local insights, Roberto A. Sanchez will provide a detailed Comparative Market Analysis (CMA) to help you set a competitive price.

Step 5: Market Your Home Effectively

Marketing is key to attracting the right buyers. Sanchez Realty Group uses a combination of traditional and modern marketing techniques to ensure maximum exposure:

Professional Photography and Virtual Tours

High-quality photos and virtual tours are essential in today’s digital market. They give buyers a clear and appealing view of your home before scheduling a visit.

Online Listings and Social Media

Your home will be featured on top real estate websites and social media platforms, reaching buyers locally and beyond.

Targeted Advertising

Roberto leverages data-driven strategies to target buyers actively searching for homes in Clifton and Fairlawn, NJ.

Step 6: Navigate Offers and Negotiations

Receiving offers is exciting, but understanding the details is essential. Roberto will:

- Explain the terms and conditions of each offer

- Negotiate on your behalf to secure the best price and terms

- Guide you through contingencies, inspections, and appraisal requirements

Step 7: Close the Sale

The closing process involves several steps, including:

- Finalizing paperwork

- Ensuring all inspections and appraisals are completed

- Working with attorneys and title companies

Roberto Sanchez is your best agent choice and his expertise ensures a smooth and stress-free experience from start to finish.

Common Questions About Selling a Home in Clifton

How Long Does It Take to Sell a Home in Clifton?

The timeline depends on factors like market conditions, pricing, and property preparation. On average, homes in Clifton sell within 30 to 60 days.

What Costs Are Involved in Selling?

Common costs include:

- Real estate agent commissions

- Repairs and staging expenses

- Closing costs (such as attorney fees and transfer taxes)

- Roberto Sanchez will provide you a net sheet with estimated costs and

- An give you potential costs and tentative expenses upfront.

Why Choose Sanchez Realty Group?

With decades of experience, Roberto A. Sanchez and the Sanchez Realty Group have built a reputation for excellence. Our commitment to client satisfaction, innovative marketing strategies, and local expertise make us the top choice for selling your home in Clifton, Roberto’s last 10 listing based sales in the last couple of months as of this writing are 6.8% higher than competing agents, that means you get to put more of your hard earned equity in your pocket, in addition on buyers based sales Roberto is more compelling due to higher NEGOTIATION skills and training. He ALWAYS have his client’s best interest in front and strived to get the best results and it shows. We hope this complete guide to selling your home in Clifton can give you important information if your looking to maximize your home sale.

Ready to Sell Your Home in Clifton?

Don’t leave your biggest investment to chance.

Contact Sanchez Realty Group today for a personalized consultation and let’s work together to achieve your real estate goals and exceed your expectations!

Call/text or email me TODAY 973-216-1945, rsanchez@robsrealtor.com

Contact Us For A Consultation

Are You Curious About Your New Value?