5 Ways to Buy Your Next Home CASH!

How Home Equity May Help You Buy Your Next Home Cash

For many homeowners, is very possible to buy your next home cash, this is why, the idea of buying your next home cash may feel like a distant dream. However, leveraging your home equity could make it a reality. Home equity is often one of the most powerful financial tools at your disposal, enabling you to transition into a new home with minimal or no financing in some cases.

In this blog post, we’ll explore how home equity works, the steps to access it, and why now might be the perfect time to use it. Along the way, we’ll highlight tips to maximize your equity and provide insights to help you make informed decisions.

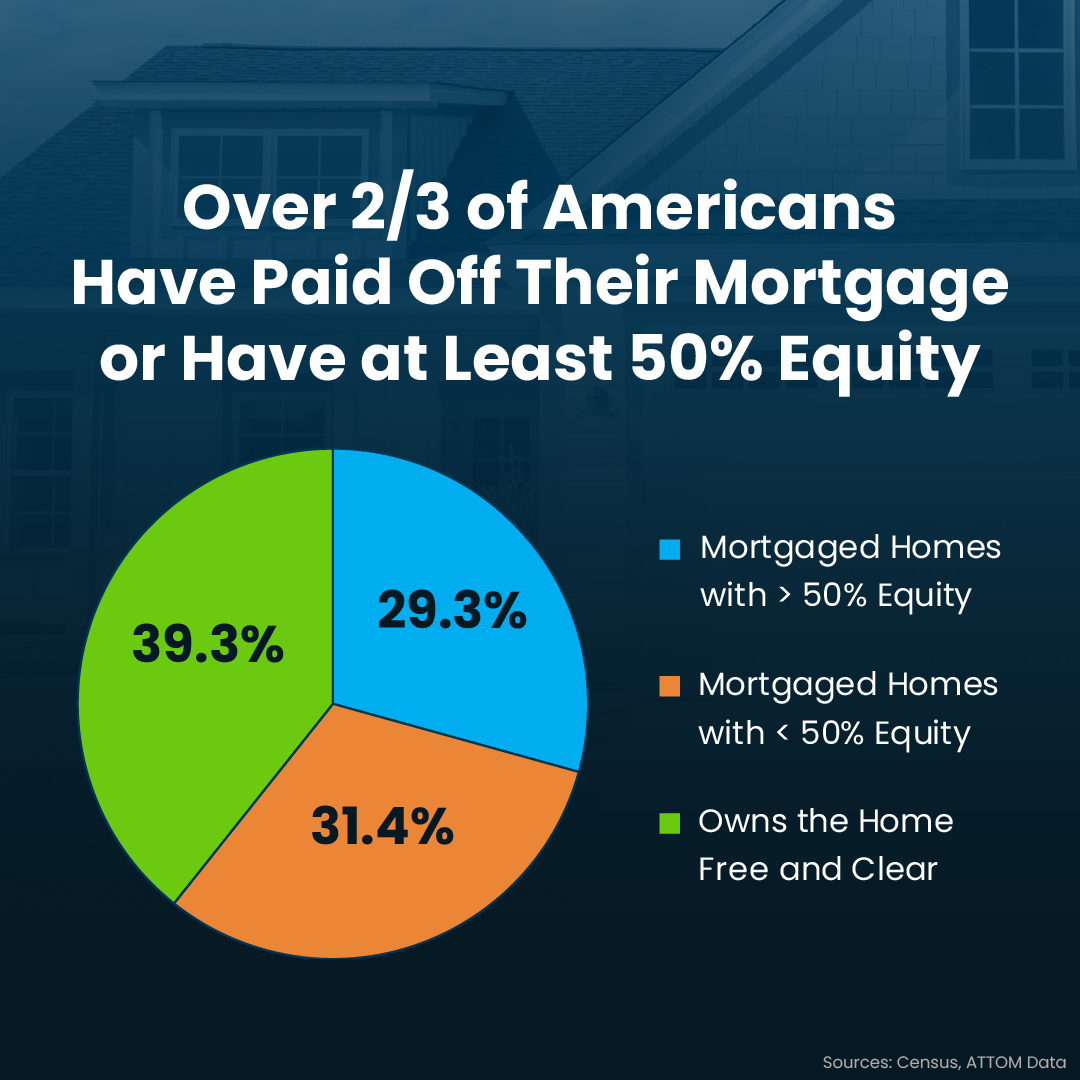

These are the stats for most homeowners in the US.

Over 2/3 of homeowners have either paid off their mortgage or have at least 50% equity in their home. And here’s what this really means for you. If you’re a homeowner wondering if it even makes sense to move right now, you should know you could have enough equity to buy your next house outright — no mortgage, no worrying about today’s rates.

What Is Home Equity?

Home equity is the difference between your home’s current market value and the outstanding balance on your mortgage. For example, if your home is worth $500,000 and your mortgage balance is $200,000, you have $300,000 in equity.

Over time, your equity grows as you pay down your mortgage and as your home’s value increases. This equity can be a powerful financial resource to help fund your next home purchase.

Key Benefits of Leveraging Home Equity

- Buy in Cash: Use equity to eliminate mortgage payments on your next home.

- Competitive Advantage: Cash offers often win in competitive markets.

- Simplified Transactions: Cash purchases usually involve fewer contingencies and faster closings.

- Leverage your Equity: Next to cash is putting down a substantial amount, 30, 40, or 50% is best if purchasing a higher-priced home or getting a lower mortgage.

Ways to Access Your Home Equity

To unlock your home equity, consider these popular methods:

1. Selling Your Current Home

Selling your home is the most straightforward way to access your equity. After paying off your existing mortgage, the remaining proceeds can be used to purchase your next property in cash.

Pro Tip: Before listing your home, consult a real estate expert to determine its market value and how much equity you can expect to cash out.

2. Home Equity Loan or Line of Credit (HELOC)

If you plan to buy a home before selling your current property, a HELOC or home equity loan can provide the necessary funds.

- Home Equity Loan: Borrow a lump sum against your equity.

- HELOC: A flexible line of credit you can draw from as needed.

3. Cash-Out Refinance

A cash-out refinance involves replacing your existing mortgage with a larger one and withdrawing the difference as cash. This option is ideal for homeowners who want to maintain their current home while buying another, IF YOU HAVE A MULTI-FAMILY home, it might be a sound decision to convert it into a positive cash-flow rental.

Step-by-Step Guide to Using Home Equity to Buy Your Next Home

Step 1: Assess Your Home’s Value

Start by getting a professional home valuation or a Comparative Market Analysis (CMA) from a local real estate agent.

Step 2: Calculate Your Equity

Subtract your outstanding mortgage balance from your home’s market value. This is your available equity.

Step 3: Explore Financing Options

Decide how you want to access your equity. If selling your home, work with a real estate agent to determine the best timing and strategy.

Step 4: Plan Your Next Purchase

Research neighborhoods, price points, and property types for your next home. Having a clear plan will streamline the buying process.

Step 5: Execute Your Strategy

Work with professionals—real estate agents, lenders, and financial advisors—to finalize your sale and purchase.

Why Now Is a Great Time to Leverage Home Equity

Current market conditions may favor homeowners looking to cash in on their equity. Here’s why:

High Home Values

Home prices have risen significantly in recent years, boosting equity levels for many homeowners.

Limited Housing Inventory

Cash offers give you a competitive edge in a market with limited supply and high demand.

Low Inventory, High Demand

A strong seller’s market means you can maximize your equity when selling your current home.

Tips to Maximize Your Home Equity

1. Make Strategic Renovations

Focus on upgrades that provide high returns, such as kitchen remodels or energy-efficient improvements.

2. Reduce Outstanding Debt

Pay down your mortgage as much as possible to increase your equity.

3. Time the Market

Sell when home values are at their peak for maximum equity gains.

Potential Challenges and How to Overcome Them

Challenge 1: Timing the Sale and Purchase

It can be tricky to coordinate selling your current home and buying your next one.

Solution: Consider a temporary rental or bridge loan to ease the transition. We have extensive experience negotiating and your best options with buyers in a market favorable to sellers is to possible to arrange extra time to close or work out a sale/rent agreement if needed.

Challenge 2: Fluctuating Home Prices

Market volatility could affect the value of your home.

Solution: Stay informed about market trends and work with a knowledgeable real estate agent.

Let’s Make Your Cash Purchase a Reality

Ready to turn your home equity into a cash offer for your next dream home? Contact us TODAY and The Sanchez Realty Group at United RE for a personalized consultation. We’ll help you assess your equity, navigate the market, and find the perfect property.

0 Comments