by robwp |

Buying a Home Grants in New Jersey

Buying a home grants in New Jersey: Are Grants Available to Help You Buy a Home in New Jersey?

The biggest hurdle to purchasing a home is saving for a down payment and closing costs, so buying a home with grants in New Jersey is possible. Fortunately, numerous grants, programs, and institutions can help, with purchasing a home Grants that are designed to assist first-time buyers and those with limited financial resources. In this blog, we’ll explore the types of assistance available, focusing on how buyers in towns like Clifton and across Northern New Jersey can benefit.

Types of Homebuyer Assistance Programs

New Jersey offers several types of homebuyer assistance programs:

1. Down Payment Assistance Programs

These programs provide grants or forgivable loans to help cover down payment and closing costs.

2. First-Time Homebuyer Programs

First-time buyers often qualify for additional benefits, including reduced interest rates and grants.

3. Local Assistance Programs

Some towns and counties have specific programs to encourage homeownership in their communities.

4. Additional Resources to Consider and Review:

Check this site from the Down Payment Resource in New Jersey

Statewide Programs in New Jersey

The state of New Jersey provides several key programs for homebuyers:

1. NJHMFA Down Payment Assistance Program

The New Jersey Housing and Mortgage Finance Agency (NJHMFA) offers a forgivable loan of up to $15,000 for qualified first-time homebuyers. Key benefits include:

- No repayment required if you stay in the home for five years.

- Available in towns like Clifton and other areas of Northern New Jersey.

2. Live Where You Work Program

- This program provides low-interest mortgage options to homebuyers purchasing a home in the town where they work. It’s particularly beneficial for buyers in urban areas such as Paterson, Newark, and Jersey City.

3. Federal Home Loan Bank (FHLB) Programs

- FHLB offers grants of up to $5,000 for first-time homebuyers through participating banks. These funds can be applied toward down payment and closing costs.

Local Assistance Programs in Northern New Jersey

1. Clifton First-Time Homebuyer Program

Clifton occasionally partners with local institutions to offer grants and counseling services for first-time buyers. Programs may include:

- Homeownership workshops.

- Down payment assistance.

2. Bergen County Homebuyer Assistance

Bergen County’s Division of Community Development offers funds to help low- and moderate-income buyers purchase homes. Towns such as Hackensack, Englewood, and Fort Lee may have additional localized initiatives.

3. Essex County First-Time Homebuyer Program

Essex County provides financial assistance to eligible buyers in towns like Montclair, Bloomfield, and East Orange.

4. Morris Habitat for Humanity

Morris Habitat for Humanity offers affordable housing opportunities and financial education workshops in towns like Parsippany and Morristown.

Institutions Offering Homebuyer Assistance

Numerous institutions in New Jersey support homebuyers, including:

1. Hudson County Economic Development Corporation (HCEDC)

HCEDC provides grants and financial counseling for homebuyers in towns like Hoboken and Jersey City.

2. United Way of Northern New Jersey

United Way offers resources to help families achieve homeownership, including financial literacy workshops and grants.

3. Affordable Housing Alliance (AHA)

The AHA provides affordable housing opportunities and education for buyers across New Jersey, including programs specifically tailored for Northern New Jersey residents.

4. Local Banks and Credit Unions

Many banks and credit unions in New Jersey partner with organizations like the Federal Home Loan Bank to provide grants and low-interest loans to eligible buyers.

How to Qualify for Assistance: Buying a home with a grant in New Jersey is possible.

Each program has specific eligibility requirements, which may include:

- Income Limits: Many programs are designed for low- to moderate-income households.

- First-Time Buyer Status: Some grants are reserved for first-time buyers or those who haven’t owned a home in the past three years.

- Location: Certain programs are tied to specific towns or counties.

- Credit Requirements: A good credit score is often necessary to qualify for assistance.

Steps to Take Advantage of Homebuyer Grants in Clifton and Beyond;

- Research Local Programs: Start by exploring programs in your town or county.

- Attend Workshops: Many organizations offer first-time homebuyer workshops that provide valuable information about grants and loans.

- Work with a Knowledgeable Realtor: A local expert like Roberto A. Sanchez at Sanchez Realty Group can help you navigate available programs and find homes that fit your budget.

- Get Pre-Approved for a Mortgage: This will help you determine your budget and identify which grants and loans you qualify for.

Why Clifton and Northern New Jersey Are Ideal for Homeownership

Clifton and surrounding towns offer a wide range of housing options, from single-family homes to condos, making them perfect for first-time buyers. The area also boasts:

- Proximity to major cities like New York.

- Excellent schools and community resources.

- Access to public transportation and major highways.

By taking advantage of local grants and assistance programs, you can make your dream of homeownership a reality in Clifton and Northern New Jersey.

Sanchez Realty Group and Roberto A. Sanchez: Your Partner in Homeownership

Navigating the world of homebuyer grants and assistance programs can be overwhelming, Buying a home with grants in New Jersey is possible and you don’t have to do it alone. Roberto A. Sanchez and the Sanchez Realty Group team are experts in the Clifton real estate market and Northern New Jersey and can connect you with the resources you need to succeed.

Ready to explore your options? Contact Sanchez Realty Group at United Real Estate today and take the first step toward owning your dream home in Clifton or Northern New Jersey.

by robwp |

5 Ways to Buy Your Next Home CASH!

How Home Equity May Help You Buy Your Next Home Cash

For many homeowners, is very possible to buy your next home cash, this is why, the idea of buying your next home cash may feel like a distant dream. However, leveraging your home equity could make it a reality. Home equity is often one of the most powerful financial tools at your disposal, enabling you to transition into a new home with minimal or no financing in some cases.

In this blog post, we’ll explore how home equity works, the steps to access it, and why now might be the perfect time to use it. Along the way, we’ll highlight tips to maximize your equity and provide insights to help you make informed decisions.

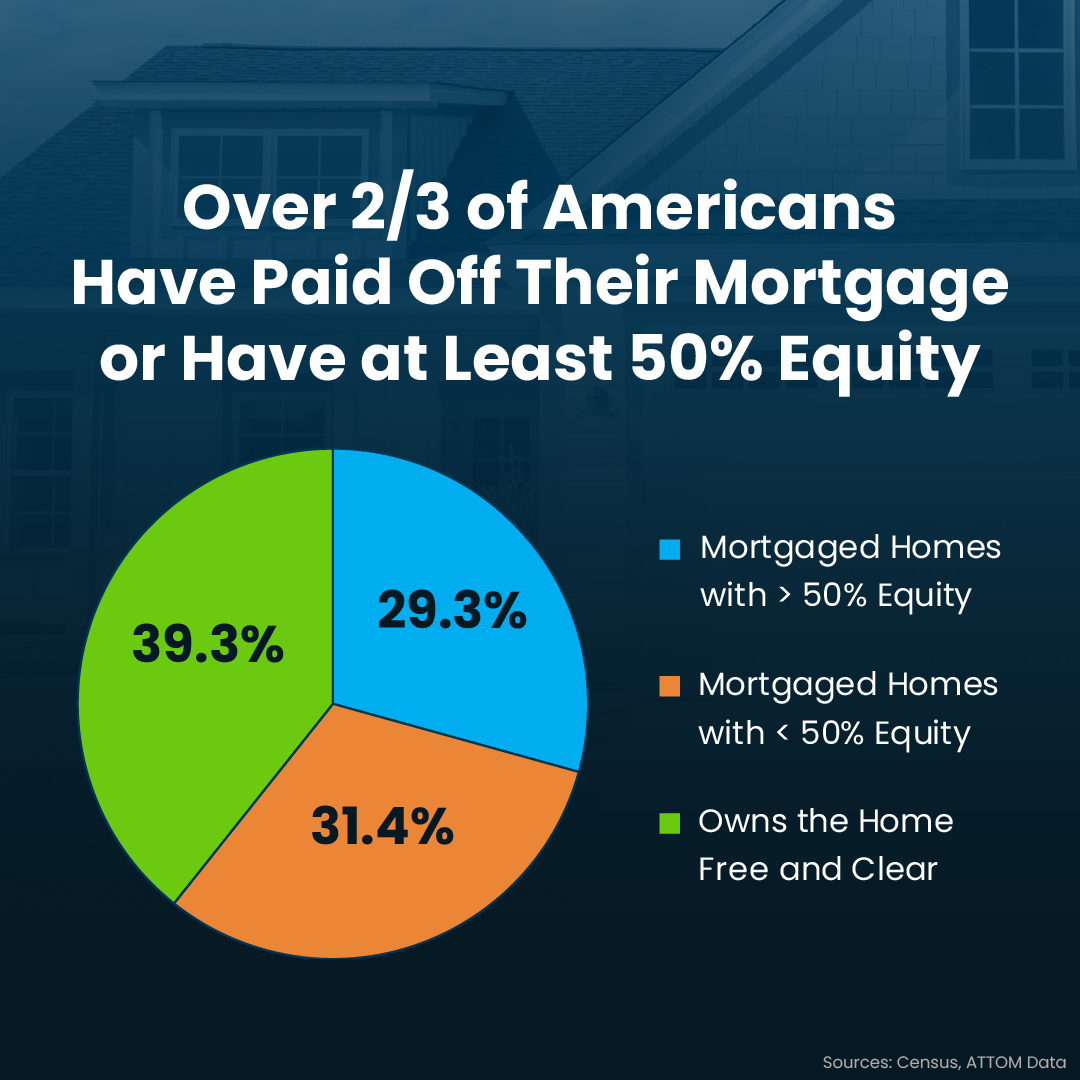

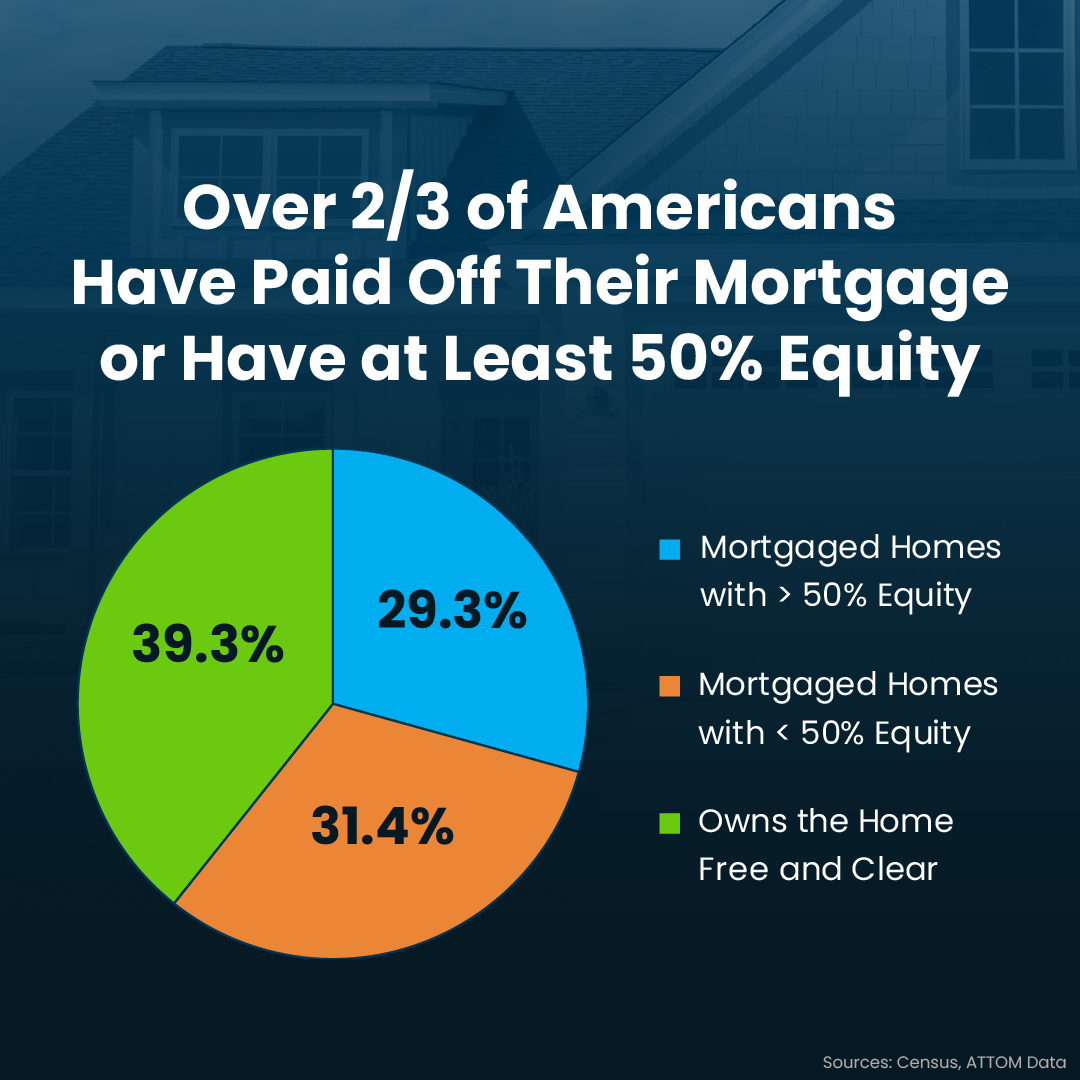

These are the stats for most homeowners in the US.

Over 2/3 of homeowners have either paid off their mortgage or have at least 50% equity in their home. And here’s what this really means for you. If you’re a homeowner wondering if it even makes sense to move right now, you should know you could have enough equity to buy your next house outright — no mortgage, no worrying about today’s rates.

What Is Home Equity?

Home equity is the difference between your home’s current market value and the outstanding balance on your mortgage. For example, if your home is worth $500,000 and your mortgage balance is $200,000, you have $300,000 in equity.

Over time, your equity grows as you pay down your mortgage and as your home’s value increases. This equity can be a powerful financial resource to help fund your next home purchase.

Key Benefits of Leveraging Home Equity

- Buy in Cash: Use equity to eliminate mortgage payments on your next home.

- Competitive Advantage: Cash offers often win in competitive markets.

- Simplified Transactions: Cash purchases usually involve fewer contingencies and faster closings.

- Leverage your Equity: Next to cash is putting down a substantial amount, 30, 40, or 50% is best if purchasing a higher-priced home or getting a lower mortgage.

Ways to Access Your Home Equity

To unlock your home equity, consider these popular methods:

1. Selling Your Current Home

Selling your home is the most straightforward way to access your equity. After paying off your existing mortgage, the remaining proceeds can be used to purchase your next property in cash.

Pro Tip: Before listing your home, consult a real estate expert to determine its market value and how much equity you can expect to cash out.

2. Home Equity Loan or Line of Credit (HELOC)

If you plan to buy a home before selling your current property, a HELOC or home equity loan can provide the necessary funds.

- Home Equity Loan: Borrow a lump sum against your equity.

- HELOC: A flexible line of credit you can draw from as needed.

3. Cash-Out Refinance

A cash-out refinance involves replacing your existing mortgage with a larger one and withdrawing the difference as cash. This option is ideal for homeowners who want to maintain their current home while buying another, IF YOU HAVE A MULTI-FAMILY home, it might be a sound decision to convert it into a positive cash-flow rental.

Step-by-Step Guide to Using Home Equity to Buy Your Next Home

Step 1: Assess Your Home’s Value

Start by getting a professional home valuation or a Comparative Market Analysis (CMA) from a local real estate agent.

Step 2: Calculate Your Equity

Subtract your outstanding mortgage balance from your home’s market value. This is your available equity.

Step 3: Explore Financing Options

Decide how you want to access your equity. If selling your home, work with a real estate agent to determine the best timing and strategy.

Step 4: Plan Your Next Purchase

Research neighborhoods, price points, and property types for your next home. Having a clear plan will streamline the buying process.

Step 5: Execute Your Strategy

Work with professionals—real estate agents, lenders, and financial advisors—to finalize your sale and purchase.

Why Now Is a Great Time to Leverage Home Equity

Current market conditions may favor homeowners looking to cash in on their equity. Here’s why:

High Home Values

Home prices have risen significantly in recent years, boosting equity levels for many homeowners.

Limited Housing Inventory

Cash offers give you a competitive edge in a market with limited supply and high demand.

Low Inventory, High Demand

A strong seller’s market means you can maximize your equity when selling your current home.

Tips to Maximize Your Home Equity

1. Make Strategic Renovations

Focus on upgrades that provide high returns, such as kitchen remodels or energy-efficient improvements.

2. Reduce Outstanding Debt

Pay down your mortgage as much as possible to increase your equity.

3. Time the Market

Sell when home values are at their peak for maximum equity gains.

Potential Challenges and How to Overcome Them

Challenge 1: Timing the Sale and Purchase

It can be tricky to coordinate selling your current home and buying your next one.

Solution: Consider a temporary rental or bridge loan to ease the transition. We have extensive experience negotiating and your best options with buyers in a market favorable to sellers is to possible to arrange extra time to close or work out a sale/rent agreement if needed.

Challenge 2: Fluctuating Home Prices

Market volatility could affect the value of your home.

Solution: Stay informed about market trends and work with a knowledgeable real estate agent.

Let’s Make Your Cash Purchase a Reality

Ready to turn your home equity into a cash offer for your next dream home? Contact us TODAY and The Sanchez Realty Group at United RE for a personalized consultation. We’ll help you assess your equity, navigate the market, and find the perfect property.

by robwp |

Clifton Housing Market Trends: What Sellers Need to Know

Why Understanding The Clifton Housing Market Trends Matters

Are you wondering, “What’s happening in the Clifton housing market right now?” Knowing current trends is essential for anyone planning to sell a home in Clifton. These insights help you determine the best pricing strategy, timing, and marketing approach. Roberto A. Sanchez and the Sanchez Realty Group at United Real Estate are experts in Clifton real estate, have in-depth knowledge of the many neighborhoods and overall market as residents over 30 years, and offer invaluable guidance to home sellers.

What Defines a Seller’s Market in Clifton?

A seller’s market occurs when there are more buyers than available homes. Clifton, NJ, is currently experiencing this phenomenon, driven by:

- Limited Inventory: The number of homes for sale in Clifton is relatively low, creating competition among buyers.

- High Demand: Buyers are attracted to Clifton for its convenient location, excellent schools, and vibrant community.

- Rising Home Prices: With high demand and low supply, home values in Clifton have steadily increased, giving sellers the upper hand.

- Buyers’ Desirability: Buyers are offered diversity, convenience and affordability

Understanding these dynamics can help sellers set realistic expectations and prepare for a smooth transaction process.

Key Trends in the Clifton Real Estate Market

Trend #1: Rising Home Prices

Clifton has seen consistent home price appreciation over the past few years. For sellers, this trend means greater returns on investment. According to recent market reports, the average home price in Clifton has increased by X% compared to last year, reflecting strong buyer demand.

Rising prices not only benefit sellers but also indicate a healthy, stable market. However, pricing too high can still deter potential buyers. Consulting with an experienced real estate agent, like Roberto A. Sanchez, can help you strike the perfect balance.

Trend #2: Low Days on Market

Homes in Clifton are selling faster than ever. The average days on the market (DOM) have decreased, signaling a robust market where well-priced homes attract offers quickly. Sellers who price competitively can expect multiple offers within days of listing.

This fast pace means sellers need to be prepared. Before listing, ensure your home is market-ready with necessary repairs, decluttering, and staging. Quick sales require strategic planning, which is where the expertise of Sanchez Realty Group becomes invaluable, negotiation skills is a must in today’s market to help you achieve your highest price gains while enjoying a stress-free possible transaction.

Trend #3: Buyer Preferences Are Shifting

Today’s buyers are prioritizing:

- Home Offices: With more people working remotely, functional office spaces are a top priority.

- Outdoor Living: Features like decks, patios, and spacious yards are highly desirable.

- Modern Kitchens and Bathrooms: Updated, move-in-ready homes often fetch higher prices.

- Open Layout and Modern Decor: Preparing your home and introducing subtle and economical updates could bear the best return on investment (ROI).

If your Clifton home aligns with these trends, you’re in a strong position to attract motivated buyers. Even if your home doesn’t currently meet these criteria, small upgrades can significantly enhance its appeal.

Trend #4: Technology-Driven Home Searches

The rise of online platforms and virtual tours has transformed how buyers search for homes. Most buyers begin their search online, presenting high-quality photos, detailed and well-crafted listing descriptions, virtual walkthroughs, and matter-port, aerial videos, and neighborhood-specific informational videos are essential. Sellers in Clifton should leverage these tools to showcase their homes effectively. Partnering with a tech-savvy real estate team like Sanchez Realty Group ensures your home receives maximum online and offline exposure.

Trend #5: Local Market Stability

Clifton’s real estate market has remained stable despite national economic fluctuations. The town’s strong sense of community, excellent amenities, and proximity to major cities make it a desirable location. This stability reassures both buyers and sellers, fostering confidence in the market.

How to Leverage Market Trends to Your Advantage

Work with an Experienced Realtor

Partnering with an experienced Clifton real estate agent like Roberto A. Sanchez ensures you have access to the latest market data and professional insights. Sanchez Realty Group excels at positioning your home to maximize its value in today’s market.

An experienced agent can also guide you through negotiations, helping you secure the best possible price and terms. Their expertise is especially critical in a fast-moving market like Clifton’s, where timing and strategy can make all the difference.

Price Strategically

Setting the right price is crucial. Overpricing can deter buyers while underpricing leaves money on the table. With expert guidance from Sanchez Realty Group, you’ll receive a detailed comparative market analysis (CMA) to determine the optimal price for your home.

Strategic pricing involves understanding both local and national trends. For example, while Clifton may be experiencing a seller’s market, broader economic factors like interest rates and inflation can still impact buyer behavior. A knowledgeable real estate agent will help you navigate these complexities.

Timing Your Sale

While the Clifton market is currently favorable for sellers, timing your sale strategically can further enhance your results. Consider seasonal trends, buyer activity, and your personal goals when planning your sale. For example:

- Spring and Summer: These are traditionally the busiest times for real estate, especially in the Northeast due to the warmer, longer days, with more buyers actively searching for homes.

- Fall and Winter: Although less busy, these seasons can still be advantageous, especially for well-prepared sellers. Serious buyers who remain active during these months are often highly motivated and ready to transact which might be best since you have a lot less competition with less homes in the market.

Enhance Your Home’s Appeal

Even in a seller’s market, presentation matters. Invest in minor upgrades, such as fresh paint, updated fixtures, and landscaping, to make your home more appealing. Staging your home can also help buyers envision themselves living there, increasing the likelihood of a quick sale.

Why Choose Sanchez Realty Group?

Selling a home in Clifton requires a tailored approach, and that’s exactly what you’ll get with Roberto A. Sanchez. With deep local knowledge and a proven track record, intrinsically knowledgeable about the Clifton Housing Market Trends, Sanchez Realty Group ensures your home stands out in the competitive Clifton market. From expert staging advice to aggressive marketing strategies, they handle every detail to secure the best outcome, always looking after your best interest.

Sanchez Realty Group’s commitment to personalized service sets them apart. By taking the time to understand your goals and concerns, they create a customized selling strategy that meets your needs. Their extensive network and marketing expertise further enhance your home’s visibility, attracting qualified buyers and maximizing your return.

Conclusion

Understanding housing market trends is key to a successful home sale in Clifton, NJ. By staying informed and working with an expert real estate agent like Roberto A. Sanchez, you’ll be well-equipped to navigate the market and achieve your goals.

Selling a home is a significant milestone, and you don’t have to go through it alone. Contact Sanchez Realty Group today to schedule a consultation and take the first step toward a successful sale.